Photo credit: Randy Francisco

Last month, GenOn Holdings, Inc. announced that it would retire the Cheswick Generating Station in September*, after more than fifty years of operation. To those familiar with the plant, and with the long-declining use of coal for power generation both nationally and in Pennsylvania, this decision was only a matter of time. Nevertheless, the Pennsylvania Coal Alliance rushed to blame the Commonwealth’s planned entry into the Regional Greenhouse Gas Initiative (RGGI) as the reason for the plant’s demise, a claim that is inaccurate and misdirected. Many factors are contributing to the closure of the plant but what the Pennsylvania Coal Alliance really misses is that Pennsylvania’s participation in RGGI could actually help the community around the Cheswick plant adjust to its closure.

First, what is RGGI?

RGGI is a regional effort among Northeastern and Mid-Atlantic states to reduce carbon dioxide (CO2) emissions from electric power plants. The eleven participating states create comparably strict CO2 budgets that ratchet down every year. Covered power plants have to buy an allowance for every ton of CO2 pollution they emit, which means that plants producing less or no CO2 are at a competitive advantage. Proceeds from allowance sales are returned to states for investment in a wide range of programs that further reduce pollution, create jobs, mitigate climate impacts, and assist with economic transition. Pennsylvania is poised to be the 12th participating state, pending approval of a final rule that received overwhelming public support during the public input process and in public opinion polls.

So if RGGI is intended to reduce CO2 emissions from power plants, and we know coal-fired power plants like Cheswick are the most intense CO2 polluters, how do we know RGGI may seem like an easy target to blame for didn’t cause Cheswick’s to retirement?

How do we know RGGI isn’t the cause?

First, the timing makes no sense. CO2 limits are not yet in effect in PA, and the earliest they could possibly come into force is early 2022. That’s assuming the rule clears two more administrative votes and the legislature fails in its ongoing attempts to derail or stop the process. Yet, GenOn will retire the plant in September, well before the rule would go into effect. If the plant was profitable but for RGGI, why not keep it running until the rule actually kicks in?

Second, GenOn’s press release announced the retirement of coal plants outside PA as well. The Morgantown Generating Station in Maryland will retire five years earlier than previously announced, and Maryland has been a RGGI participant since its inception in 2009. More importantly, the Avon Lake power plant in Ohio is also retiring on the same day as Cheswick, and Ohio has no plans to enter RGGI or otherwise limit CO2 pollution. This development is a clear counterpoint to RGGI opponents’ arguments that coal plants in Ohio and West Virginia will benefit from Pennsylvania entering the program. Clearly, other more significant factors are at play in the widespread decline of coal.

Third, and most obviously, GenOn itself publicly cited multiple reasons for the decision to retire the three plants, and RGGI was not one of them. Instead, GenOn cited “unfavorable economic conditions, higher costs including those associated with environmental compliance, an inability to compete with other generation types, and evolving market rules that promote subsidized resources.” We’ll unpack some of those claims below, including the rather Orwellian claim about unfair market rules but power plant owners are generally not shy about blaming uncontrollable forces for their own business decisions, and the fact that GenOn said nothing about RGGI is telling.

So why is Cheswick actually retiring?

Market forces

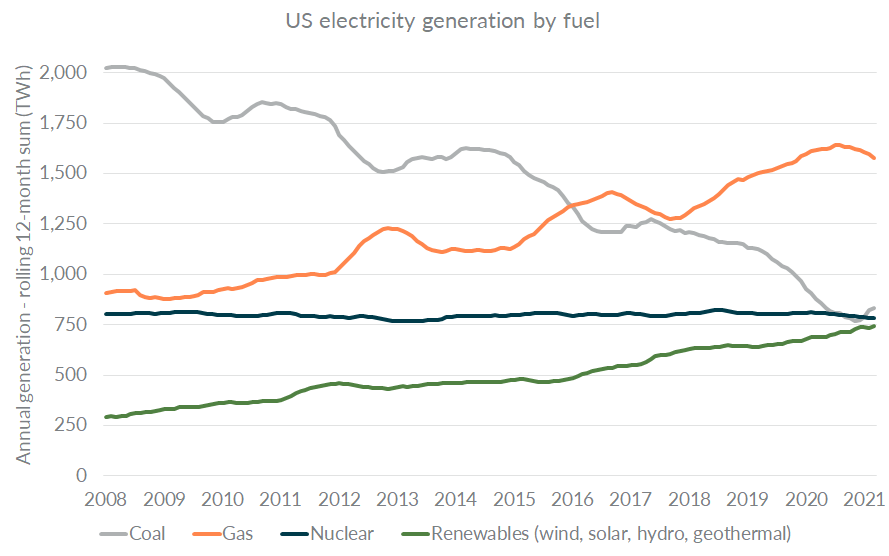

First and foremost, all coal plants are losing market share because coal-fired power plants are an obsolete technology. As the graph below indicates, coal has been losing ground to renewable energy and so-called “natural gas,” a product of fracking, since 2008. At that time, it provided about 50% of the electricity in the US; now it only provides 20%.

Image credit: John Romankiewicz, Sierra Club, based on data from the Energy Information Administration (eia.gov)

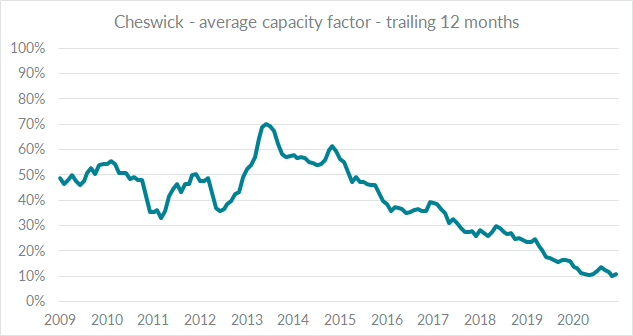

Cheswick was not immune to this national trend as its capacity factor (the amount it actually produces as a percent of what it can produce if it ran at full steam all the time) fell precipitously from a high of 70% in 2013 to around 10% today:

Image credit: John Romankiewicz, Sierra Club, based on data from the Energy Information Administration (eia.gov)

The fact that coal is not the cheapest available power source during most hours of most days presents a major problem for plants like Cheswick, which were designed to operate at full steam nearly all the time.

Well-documented technological advancements in wind and solar power, as well as persistently low fracked gas prices have been a major driver of this trend. The result in Pennsylvania has been that 17 of the 20 conventional coal-fired power plants that operated in 2010 have either retired, announced plans to retire, or stopped burning coal. (This includes Cheswick, but does not include a dozen heavily subsidized small plants that burn coal refuse for electricity).

Environmental compliance

Another important factor, as GenOn’s release acknowledges, is environmental compliance. For decades after the passage of the Clean Air and Clean Water Acts in the 1970s, existing coal-fired power plants were able to exploit loopholes that allowed them to continue producing excessive amounts of pollution. Cheswick didn’t get around to installing “scrubbers” to remove sulfur dioxide (SO2, which causes acid rain) and mercury (a potent neurotoxin) until 2010. It installed controls to remove smog-causing nitrogen oxides (NOx) a few years earlier, but didn’t consistently operate those controls (analogous to the catalytic converter on cars) until state regulations clamped down in 2017 after years of advocacy by Sierra Club and our allies. Operating these necessary controls comes with a cost that makes Cheswick’s electricity even less competitive.

On the water side, Cheswick faced additional hurdles. In 2015 the EPA clamped down on the amount of toxic water pollution (primarily mercury, arsenic, and selenium that are present in coal ash) that plants could discharge. Even though the Trump administration (probably illegally) weakened the standards and extended the compliance timelines, Cheswick was still facing the possibility of spending tens of millions of dollars on water treatment upgrades to comply.

Cheswick is also the last remaining large coal plant in the state without cooling towers, which prevent the discharge of superheated water that can severely disrupt aquatic ecosystems. In the course of our advocacy to incorporate the new federal water pollution requirements into Cheswick’s water pollution permit, we found that they were already violating their thermal pollution limits by increasing the temperature of the Allegheny River as much as a mile downstream. Sierra Club’s litigation against the plant for this violation is still pending, and our expert in the case concluded that the installation of cooling towers would be necessary to prevent future violations of the thermal limit. That would represent another huge compliance expense.

Loss of anticipated revenue from historically low capacity market results

But the final straw, given the timing of the announcement, had to be the announcement of the PJM capacity market results. PJM is the regional grid operator for much of the mid-Atlantic US, extending west to the Chicago area. It runs an annual auction to pay for power plants to be available for standby power whether or not they actually run. This is intended to ensure that there is always enough generation capacity available, even during times of peak electricity demand (usually temperature extremes).

The auction usually is an annual event but had been delayed by several years due to a rule change that had to work its way through a divided Federal Energy Regulatory Commission (FERC) before coming into effect. The rule change was actually intended to exclude state-subsidized resources from the market (not favor them, as GenOn claimed), and its design was expected to make it much more expensive for state governments to meet their clean energy and climate targets, while ignoring the suite of indirect and hidden subsidies benefiting fossil fuels. The result was expected to be higher capacity payments that disproportionately benefited fossil power plants - a windfall that GenOn was counting on to keep the unprofitable Cheswick afloat.

Surprisingly though, when the auction results were made public on June 2, they were among the lowest ever at $50 per MW-day, down from $140 / MW-day in the last auction. The upward price pressure from the attempted exclusion of some zero and low emission sources was outweighed by downward price pressure from a glut of generation overall and significantly lower forecasts of electricity demand. Not only did GenOn fail to get the higher prices they were expecting for Cheswick’s standby capacity, Cheswick was likely priced out of the auction altogether. Facing the expectation of the higher environmental compliance costs we just discussed, this lack of anticipated revenue is surely why the plant’s retirement announcement came just a week after the long-awaited auction results were posted.

How can RGGI help?

Cheswick will be shut down in September, and a similar fate is projected for the three remaining large coal plants in Pennsylvania by mid-decade even if we don’t adopt RGGI (see slide 13 of this analysis). It is not a matter of whether or even when these plants will close. The real questions are, will we have a plan in place to help communities and workers deal with the loss of the plant and will that plan have the financial resources needed to implement a real transition?

The resource question is where RGGI can help. As described above, under RGGI, allowances for CO2 pollution are auctioned off, and the proceeds are returned to states for investment. Due to its large fleet of generators, Pennsylvania will have the largest CO2 budget of any participating RGGI state, and therefore stands to receive more funding from auction proceeds than any other state. In fact, with a first year budget of 78 million tons, and if the recent auction price of $7.97/ton holds, PA stands to take in over $620 million dollars for reinvestment in the first year alone. Even at the minimum allowance price we would see $181 million in the first year, a significant sum.

If we adopt an investment plan that includes power plant host communities among our top investment priorities, this money could go a long way toward replacing wages, tax receipts, and indirect jobs lost by the inevitable plant closures.

A recent report from the Ohio River Valley Institute offers some perspective from other states on how this money could make a difference. One example is in Colorado (which is not a member of RGGI or any similar program), which passed the “Just Transition from Coal Based Electrical Energy Economy Act” in 2019. The result was the development of a comprehensive plan that is focused on communities hosting power plants and mines, driven by stakeholders including labor leaders and local community representatives, with input from issue experts and state agencies. It includes ten overarching strategies, with six focused on communities and four focused on workers. Critically, it is estimated that the plan will cost $100 million to fully implement, but so far the state has only appropriated $15 million, and is not sure where the remaining $85 million will come from.

Pennsylvania would do well to emulate Colorado’s planning process for local economies that rely on coal extraction or burning, especially with the knowledge that we would have a funding source at the ready.

*GenOn recently announced on July 19th that Cheswick's retirement would be moved from September 15, 2021 to April 2022.

This article was written by Tom Schuster, Clean Energy Program Director for the Sierra Club Pennsylvania Chapter. Tom can be reached here.