The Public Service Commission (PSC) is accepting comments for the Strategic Energy Assessment, which 'profiles the state’s electric system including past and future electric energy needs and sources of supply, electric rates and bills, and the availability, reliability, and sustainability of Wisconsin’s electric energy supply.'

Here are Sierra Club's comments on what the future and benefits of clean energy in Wisconsin should be!

We are here on behalf of the Sierra Club-John Muir Chapter and the over 18,000 members and supporters in Wisconsin, working to promote clean energy and protect clean air and water resources in Wisconsin.

Rates and customer energy efficiency

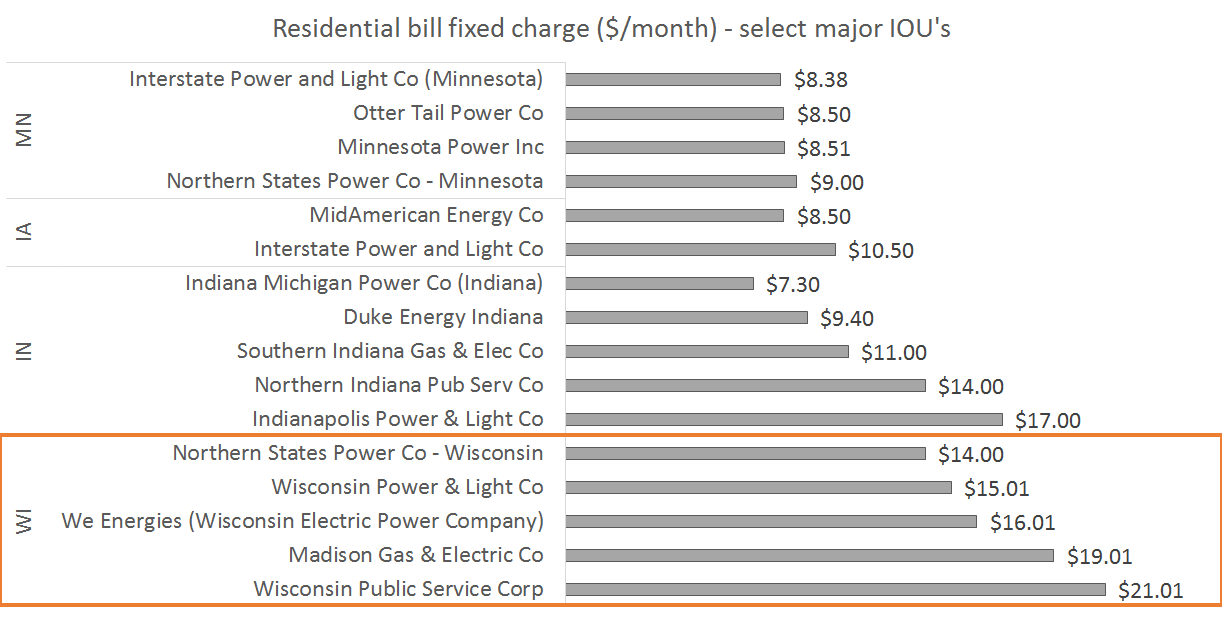

Figure 34 shows that rates in WI are above the Midwest average, with the document referencing the difference as “slightly higher”. It’s actually almost 20% higher than the average of rates in IN, MN, and IA, for residential customers in 2016 (and 12% above the average rates of all Midwest states). The document also does not mention WI utilities’ high fixed charges for residential customers, which are among the highest in the Midwest. We understand this is not a forum in which rates are set, but understanding these rates matters because they impact the future development of energy in the state. Fixed charges are regressive (impacting low-income customers more) and disincentivize energy efficiency and rooftop solar.

In spite of this challenge, Wisconsin’s Focus on Energy program has had some success encouraging energy efficiency investments - it has generated $3.00 in benefits ($4.32 if including a wider scope of benefits) for every $1.00 in costs. But this effort could be improved further if Wisconsin had a rate structure more in line with its neighbors. We encourage the SEA to be a venue to explore the potential for increasing the scope of programs with such good cost-benefit ratios.

Planning reserve margin

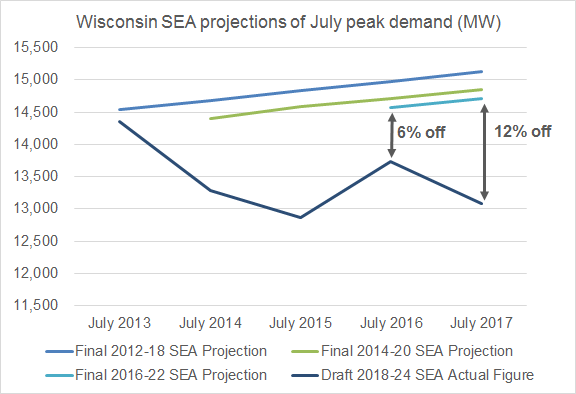

We are concerned that Wisconsin is apparently planning for future energy needs based on an assessment of peak load growth that may be inaccurate. While the SEA notes that peak load will only increase modestly 0.5% per year between 2018-2024, it is projecting a massive 8% jump in peak July and August load from 2017 to 2018, allegedly due to weather related impacts. But it is exceedingly unlikely for peak demand to grow that much in one year absent extraordinary circumstances. This would not be the first time an SEA has overprojected demand: SEA’s last few projections have consistently overstated demand (as shown in Table 4), with the most recent SEA projection for July 2017 peak load 12% higher than actual levels of peak load that occurred.

This potential over-projection matters because SEA may be inflating overall demand, thereby masking a possible oversupply of power that could be costing Wisconsin ratepayers millions of dollars. Thus, we recommend that the SEA look again at weather normalized peak demand for historic data (for figures 5-7), being sure to cite what weather data are being used for 2018.

Furthermore, although Wisconsin Law of course requires that the PSC conduct this assessment for the entire state of Wisconsin, we believe it should still be conducting this analysis at a utility level rather than combining multiple differently run utilities into a single statewide analysis. MISO does not require a reserve margin for a state but rather for each load serving entity. The relevance of the PSC’s state based analysis of reserve margin is therefore questionable. A utility-by-utility integrated resource planning process (which is the norm in most regulated, vertically-integrated utility states) allows grid planners and policymakers to understand and address the medium- and long-term issues associated with each utility’s individual system. This limit is seen most obviously when the SEA makes vague statements that “some additional purchases may be necessary”, when really there is likely only a need in certain utilities. Thus, we encourage the PSC to run utility-level analyses to more fully and accurately understand the future of energy in Wisconsin.

Renewables

We also encourage SEA to incorporate a wide variety of reliable, widely-used, industry-based sources in quoting the cost of renewable energy, such as Lazard and Bloomberg New Energy Finance. The document currently notes that EIA says the LCOE for wind is $48/MWh (without the PTC). Bloomberg New Energy Finance has found the cost in Wisconsin to be $29/MWh with the PTC (and $38/MWh without), while tracking solar PV is $40/MWh (including the ITC). We also note that even the industry standard numbers are conservative in many ways: for instance, Dairyland Power Coop signed a PPA in Feb 2017 with Iberdrola for an 80 MW wind purchase at $17.50/MWh (FERC quarterly report data).

We are starting to see more power purchase agreements for wind and solar under development by Wisconsin utilities, but even with these new projects the renewable levels are incredibly low compared to neighboring utilities in Minnesota and Iowa, such as Xcel Energy and MidAmerican Energy. 37% of generation in Iowa is from wind, while only 3% in Wisconsin, and the RPS is only 10% in Wisconsin. Even accounting for the fact that Wisconsin’s wind resource is not as strong as Iowa’s or Minnesota’s, the level of wind development is still well below average and turbine technology is continually improving to allow sites with lower wind resources to be developed at competitive pricing. Given that the cost of building new renewables is becoming lower than the cost of operating coal plants, and as the SEA notes in reference to MG&E (and other utility) renewables goals that “Such goals reflect the lower prices of renewable energy, customer preferences, state and federal policy, and environmental stewardship,” the question is why aren’t Wisconsin utilities moving faster and why isn’t the Strategic Energy Assessment encouraging utilities to move faster on