Banks Continue to Prop Up Fossil Fuels as the Climate Crisis Accelerates

While clean energy ramps up, lenders keep fossil fuels alive

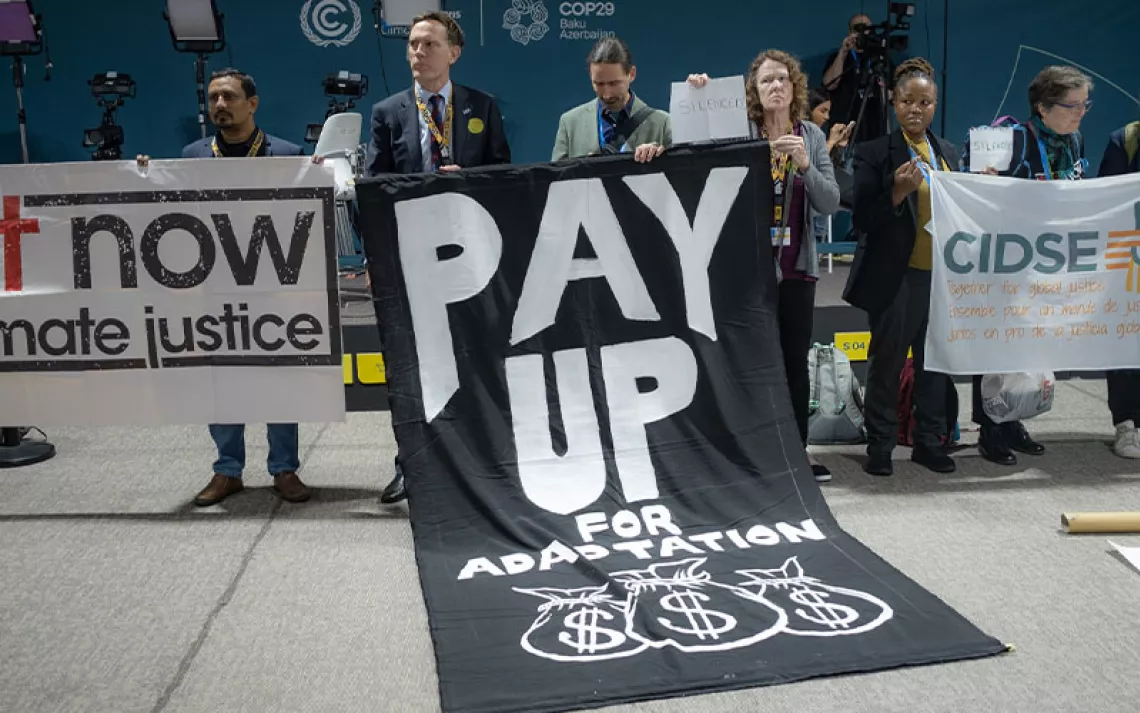

Protesters from the environmental group Extinction Rebellion stage a sit-in outside Citibank global headquarters to raise awareness about the climate crisis during the bank's annual shareholders' meeting on April 25, 2023, in New York City. Citibank is the second-largest financier of fossil fuels worldwide and the leading financier of fossil fuel expansion. | Photo by Michael Nigro/Sipa via AP

In his 2023 letter to shareholders, JPMorgan Chase CEO Jamie Dimon called for a more robust response to climate change that moves beyond “simplistic statements and rules.” “The climate challenge is immense and complex,” he wrote. “Addressing it requires more than making simplistic statements and rules; rather, energy systems and global supply chains need to be transformed across virtually all industries.”

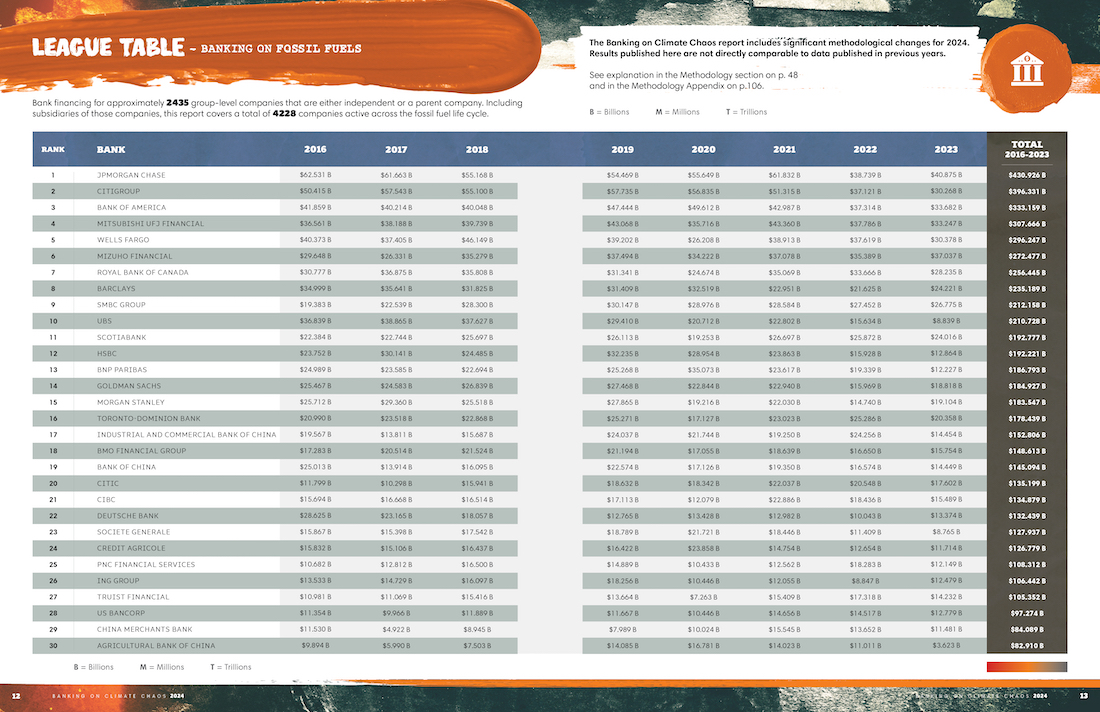

That transformative change has yet to become policy for JPMorgan Chase itself, according to the latest edition of the Banking on Climate Chaos report. Since the Paris Agreement was signed in 2015, the largest bank in the United States has committed nearly half a trillion dollars—$430 billion in total—to support fossil fuels. Of the world’s top 60 lending institutions, the two largest banks in the US—JPMorgan Chase and Bank of America—round out the top three biggest lenders to the fossil fuel industry.

“The world’s largest banks continue to pour hundreds of billions of dollars every year into fossil fuels,” said Ben Cushing, the campaign director for the Sierra Club’s Fossil-Free Finance campaign. The Sierra Club is one of the authoring organizations of Banking on Climate Chaos. “These are the same companies producing coal, oil, and gas in a way that are misaligned with the Paris Agreement and the just transition to a clean energy future.”

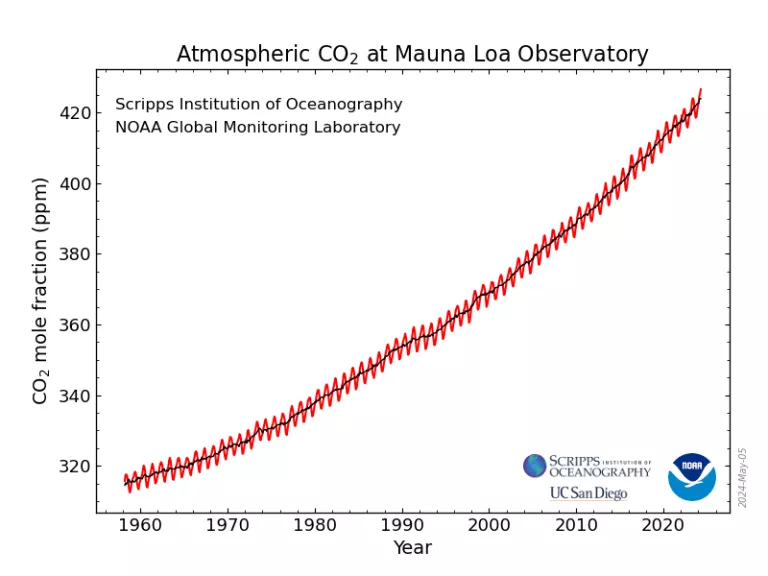

In the same year that Dimon penned his letter to shareholders, the planet crossed a series of grave climate thresholds. In 2023, pollution from fossil fuels reached record levels, with increases of three heat-trapping gases—carbon dioxide, methane, and nitrous oxide—showing no signs of slowing down, according to NOAA. The planet breached a global average threshold of 2.7°F, or 1.5°C, above preindustrial levels for the first time—the critical benchmark set by the Paris Agreement for keeping dangerous global warming in check. There have now been 11 consecutive months that set monthly temperature records, often by large margins.

During this same time, JPMorgan Chase boosted its financing of fossil fuels from $38.7 billion to $40.8 billion, according to the new analysis. For 2023, the bank ranked worst among lending institutions that committed financing to companies with plans for fossil fuel expansion.

“At the same time that fossil pollution is spreading death through record heat, months of rain pouring down in hours, and other once extreme weather events, fossil banks keep banking on climate chaos,” Diogo Silva of the group BankTrack, one of the report coauthors, said in a statement. “We call on the banks to finally become fossil-free banks, and on the wider climate justice movement to use this data to mobilize for a fossil-free banking world.”

JPMorgan Chase isn’t alone. The world’s leading financial institutions continued supporting the industries most responsible for producing climate-warming emissions. The 60 biggest banks committed a total of $705 billion to the fossil fuel industry in 2023. That includes $120.9 billion to 130 companies that are expanding liquefied methane gas operations; $42.5 billion in financing to 211 coal mining companies; $59 billion for 236 companies involved in fracking; and $4.4 billion for the top 36 tar sands companies. The report found that American banks provided a full third of all fossil fuel financing worldwide in 2023.

In total, since 2016, the 60 biggest banks globally lent $6.9 trillion to companies involved in oil, gas, and coal operations. According to a Carbon Majors database report released this past April, a full 80 percent of the world’s carbon dioxide, methane, and nitrous oxide emissions come from those same operations, and these heat-trapping emissions can be traced to just 57 companies and nations.

The Banking on Climate Chaos “Dirty Dozen” list of the world’s biggest lenders to oil, gas, and coal is dominated by banks in just four countries: the United States, Japan, Canada, and the United Kingdom. JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and Morgan Stanley hold the #1, #3, #5, #6, and #12 slots, respectively. Japan’s Mizuho Financial, MUFG, and SMBC hold the #2, #4, and #8 spots. Canada’s RBC, Scotiabank, and Toronto-Dominion Bank hold the #7, #10, and #11 slots. In the United Kingdom, Barclay’s comes in at #9.

Meanwhile, banks are rolling back their climate action policies. Researchers found that most banks are now backing decarbonization programs for existing fossil fuel projects rather than policies that would end financial support for those projects. Bank of America was found to be the worst participant in this trend. The bank abandoned its commitment to exclude Arctic drilling operations and coal-fired power plants from its lending practices. Bank of America has the worst record for financing companies that are extracting fossil fuels in the Amazon. It committed $162 million in 2023 for those operations.

The lending industry for fossil fuel financing continues to be rife with greenwashing, according to the analysis. Banks looking to present themselves as climate conscious will often publicize “Net Zero by 2050” policies along with commitments to end direct financial support to new fossil fuel projects. But the vast majority of companies involved in fossil fuels take on debt from banks for what they label as “general corporate purposes,” not for specifically named projects. This creates a gaping loophole: A bank can say it no longer supports new fossil fuel projects while it continues to lend billions of dollars to fossil fuel companies for general corporate purposes.

“Banks that profit from climate chaos invent new greenwash every year, but we have the receipts that show how much money they put into fossil fuels,” said April Merleaux, research and policy manager at Rainforest Action Network, another report coauthor. “Our new methodology uncovers previously unreported details on banks’ support for fossil fuels and gives campaigners new tools to hold them accountable.”

The analysis does show a slight downward trend of fossil fuel financing overall across the top 60 banks since 2021. But that downward trend coincides with a two-year period in which oil and gas companies earned massive windfall profits following a rebound from the pandemic and the war in Ukraine. The downward trend seems to suggest that since 2021, oil and gas companies have not needed as much lending from banks as in previous years because they are awash in cash—an ominous sign for the effort to fully transition the world’s economies to 100 percent clean energy.

The Banking on Climate Chaos report goes beyond the balance sheets to examine frontline case studies of how these lending practices impact everyday communities around the world and how those trends measure up to claims of a rapid transition to net zero. For example, researchers report that “the coal power transition looks bleak.” “New coal-fired power plants are still being built, and most coal companies are mishandling their transitions away from coal.” In Indonesia for example, the Adaro corporation is building a huge 1.1-gigawatt coal-fired power plant in North Kalimantan that has displaced communities and is emitting toxic black smoke. Coal is one of the dirtiest forms of energy generation, accounting for up to 40 percent of global carbon emissions.

“The world’s biggest banks continue to be misaligned with the goals of the Paris Agreement and achieving their own net-zero commitments."

In the United States, parallel realities are developing as a clean energy transition develops alongside ongoing fossil fuel expansion. A transition to clean energy is accelerating thanks to the implementation of the Inflation Reduction Act. But the United States continues to produce huge amounts of fossil fuels. The US is currently the largest exporter of liquefied natural gas in the world. Financial lending has helped catalyze an LNG export expansion, particularly along the Gulf Coast, in places like Sulphur, Louisiana. According to the report, LNG expansion has reached a total of $1 trillion around the world.

To achieve a true clean energy transition, according to a 2023 BloombergNEF study, banks will have to transform the relative proportion of how much they finance clean energy to fossil fuel projects such that for every $1 committed to fossil fuels, $4 is committed to clean energy. Currently, for most banks, according to the report, that ratio is one to one, or even less than one to one.

“The world’s biggest banks continue to be misaligned with the goals of the Paris Agreement and achieving their own net-zero commitments,” Cushing said. “In spite of all the policies and targets and rhetoric that the banks have put out there about climate action, they are clearly not doing enough.”

The Magazine of The Sierra Club

The Magazine of The Sierra Club