September 26, 2024

Earlier this summer, I had an interesting conversation with one of our Chapter volunteers named Homer. He wondered about the difference between donations that are or are not tax deductible. Ah, I get asked this question a lot.

To answer this question, let’s look at what 501c4 and 501c3 means in terms of your taxes and our use of funds:

- 501c4 (referred to as C4) and 501c3 (referred to as C3) are IRS designations for non profit organizations.

- C4 funds can be used for everything we do at the Angeles Chapter; C3 funds are limited in how they can be used.

- C4 donations are not tax-deductible; C3 donations may be tax-deductible.

- The Sierra Club - including the Angeles Chapter - is a C4 nonprofit organization. Gifts - whether large or small - made to the Sierra Club organization, Chapters, or Groups - are not eligible for a tax deduction. These gifts include donations made through monthly giving, fundraising events, letter campaigns, annual appeals, and contributions made through our website.

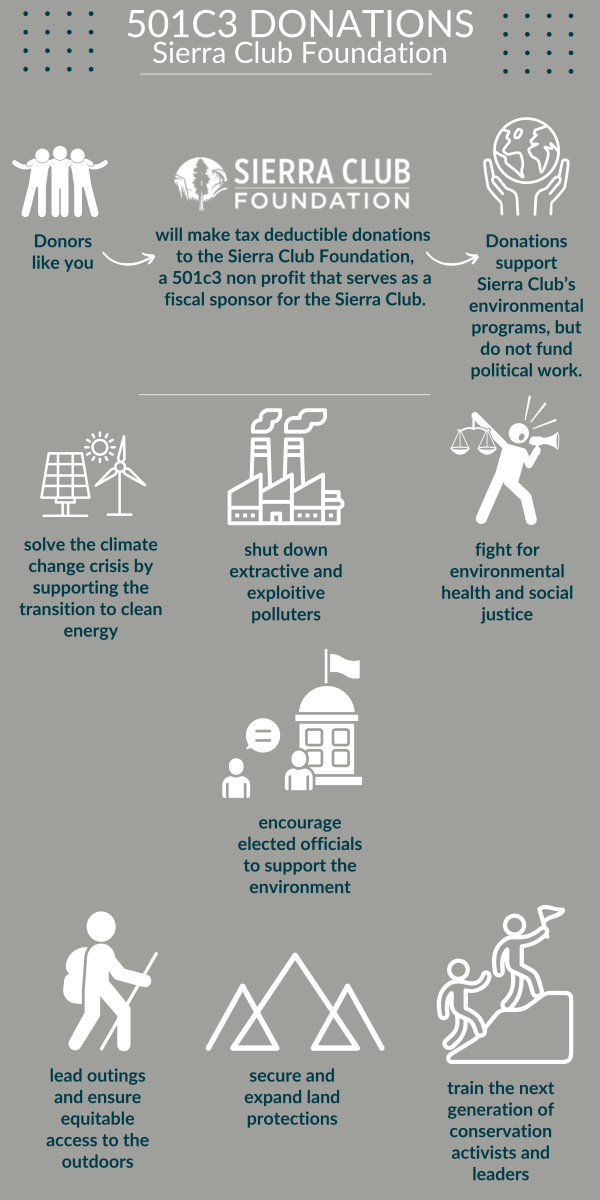

- The Sierra Club Foundation, which serves as a fiscal sponsor to Sierra Club Chapters, funds significant portions of some of the Angeles Chapter projects and is a C3 organization that affords donors an opportunity to make large donations that could qualify for a tax deduction*. These gifts are made directly to the Foundation with the expressed intent to support the Angeles Chapter. C3 donations support a lot of our work, but none of our political work. *Please note, donors who wish to make a potentially tax-deductible donation to the Sierra Club Foundation are advised to seek tax advice from a financial professional.

Why make a donation that is not tax deductible?

Even though gifts made directly to the Chapter are not tax deductible, they are the means to sustain every layer of our mission. As a C4, the Angeles Chapter can effectively lobby for environmental protections and litigate against our most threatening adversaries. As a C4, we can endorse candidates who will fight for a healthy planet, and donations generate a lot of power by educating the public about upcoming elections. But that’s not all! Take a look at our recent Impact Report to see the scope of work we did from January 2023 through June 2024. Every program was helped by gifts made directly to the Chapter.

By the way, not all C3 gifts will qualify for a deduction, so giving directly to the Chapter poses little to no effect on your taxes anyway. In 2017, tax laws changed under the Trump administration, effectively doubling the amount of the standard deduction. This means that in order to realize a tax benefit from C3 donations, your itemizations must accumulate to more than the standard tax deduction. Currently, C3 gifts will only offset your tax liability if you have more than $13,850 in qualified deductions if you’re filing single or $27,700 if you’re married and filing jointly.

Can I make a tax deductible donation to the Sierra Club?

Yes, you can! The Sierra Club Foundation is a 501c3 non profit organization that serves as our fiscal sponsors, which means they will process grants and donations on behalf of the Chapter. Gifts made to the Foundation - denoting the Angeles Chapter as the recipient - may be tax deductible if you meet the threshold for itemizing donations on your tax return as confirmed by your personal tax advisor.

The Foundation must adhere to federal guidelines which does restrict use of funds, especially concerning bias and neutrality in educating about public policy. C3 funds cannot ever be used to help candidates or influence an election. When the Angeles Chapter receives a gift that you made through the Foundation, we make sure that funds are used in compliance to these guidelines. Many of our programs are supported by these generous gifts (but never our political work). C3 funds are used either fully or in conjunction with C4 funds to support our work in Conservation, Outings, the Activist Academy, Inspiring Connections Outdoors (ICO), Military Outdoors, Communications, and so much more.

When considering a donation, think of c4 as having the breadth to fund all of our work while c3 is somewhat restricted. Also consider whether or not your gifts will impact your tax liability and how important that is to you.

Whether donating directly to the Angeles Chapter or indirectly through the Sierra Club Foundation, our commitment to environmental justice and conservation continues because of the generosity of donors who give because they care about this wondrous and fragile planet.

We appreciate your questions, your gifts, and your feedback. If you would like to explore more ways to support the Angeles Chapter, please reach out to me, Jennifer Gregg, at jennifer.gregg@sierraclub.org

If you would prefer to support the Angeles Chapter through a tax-deductible donation, please send an email to: foundation@sierraclub.org and be sure to indicate your preference for supporting the Angeles Chapter.