When bitterly cold weather struck the Midwest and Mid-Atlantic in January 2014, nearly a quarter of coal and gas plants in the region failed to start, despite their operators’ frequent boasts that their units are “always available.” Fortunately, no one lost power during this storm despite all the generators that failed to turn on. In part, this was because wind performed even better than expected, as did demand response (a practice where customers voluntarily reduce electricity usage when the grid is stressed).

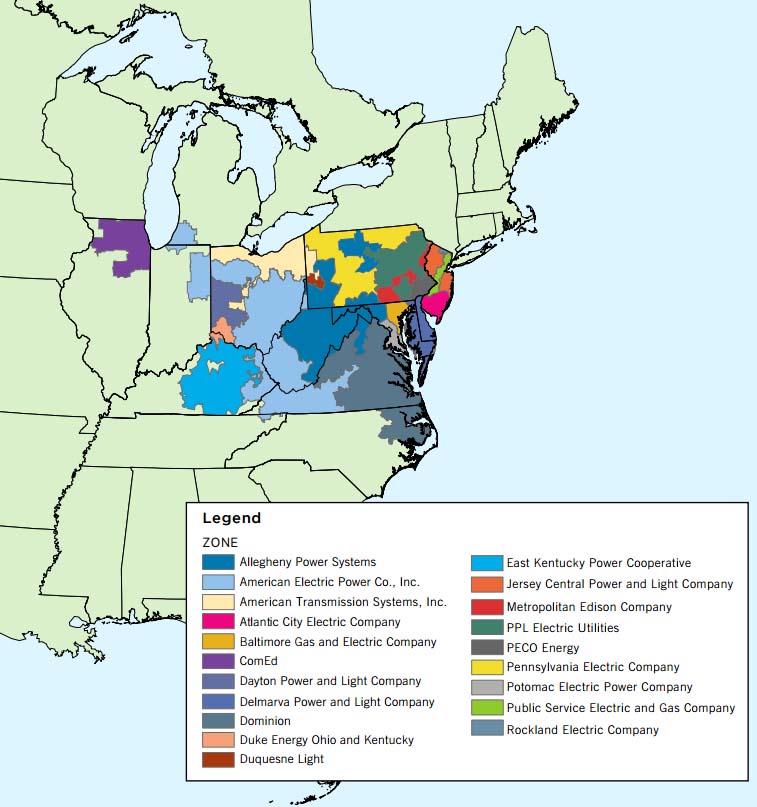

Like an old car that just can’t turn over, coal and gas plants could not operate due to frozen coal piles or gas lines, and myriad other weatherization issues that could have been prevented with modest investments. The grid operator for the region, PJM Interconnection, immediately investigated the cause of these “unforced outages” and began requiring generators to implement basic weatherization measures to resolve them. So far, so good. Next, PJM also decided that drastic changes were needed to its capacity market to create the right incentives for generators to perform as they had committed to, including penalties for failing to turn on in emergency conditions. Unfortunately, PJM rushed these changes, bypassing its stakeholder process that could have refined the new rules and tailored them to address the problem at hand. (For further background on PJM’s capacity market rules, I recommend this and other excellent blog posts by Jennifer Chen at NRDC).

As a result, the rules that PJM proposed and the Federal Energy Regulatory Commission (“FERC”) approved, are miscalibrated and significantly overreach, significantly increasing costs to consumers for little or no gain in reliability. As Chairman Norman C. Bay noted in his dissent from FERC’s approval of the rules, the rewards are too rich and the penalties too paltry to incentivize generators to perform when needed; indeed, many fossil fuel generators will receive a windfall under the new rules without needing to make the upgrades needed to perform during emergencies. The 61 million PJM customers will pay for that windfall.

In late September, the Sierra Club, NRDC, Union of Concerned Scientists, and nearly a dozen other petitioners filed a brief in the D.C. Circuit Court of Appeals challenging FERC’s approval of PJM’s new capacity market rules. The Federal Power Act requires FERC to ensure that the rules put in place by grid operators like PJM will ensure that customers’ electricity rates are “just and reasonable.” FERC failed to do so in this case. PJM’s own analysis shows that its rules are likely to have staggering costs, up to $4 billion during the first three years. (Further evidence of the rules’ increased costs can be found in the most recent capacity auction results, in which the rules were partially implemented.) That cost might be justified if it came with major improvements in grid reliability. But there is little evidence, and serious reason to doubt that PJM’s new market rules will improve reliability. As argued in our brief, the record simply does not support a conclusion that the costs of these rules are justified by any reliability benefits; as such, it was arbitrary and capricious for FERC to approve PJM’s rules.

To make matters worse, PJM’s new rules will effectively eliminate clean energy resources from participating in the capacity markets. The rules require all capacity resources to be available around the clock, every day of the year, whereas the previous rules allowed resources to be available only in certain seasons or for narrower blocks of time. Those previous rules enabled resources like wind energy, which has high capacity in the winter but lower capacity in the summer, to offer into the market as a winter-only resource. Demand response was able to bid into the market as a summer-only resource, or a resource available for only a certain number of hours a year. The grid operator needs different amounts of resources at different times of the year, and needs significantly more resources during just a few peak hours of the year. Therefore, allowing resources to bid in to more specialized product categories, rather than a single year-round, always-available product category, allowed PJM to procure exactly the amount of capacity needed at specific times. That flexibility is gone under the new rules. PJM’s decision to eliminate all seasonal resources from participating and require all resources to be available 24 hours a day, 365 days a year, severely hampers the ability of clean energy resources to participate in the market. As competition from these low-cost resources declines, prices will go up, and fossil fuel generators will see their revenues increase.

Our brief argues that this annual requirement amounts to undue discrimination against clean energy resources, which the Federal Power Act prohibits. The new requirement that capacity resources be available year-round bears no relationship to the problem PJM experienced in January 2014 of fossil-fuel generators not be available when called. It will not improve reliability, and contributes to the hefty price tag of these new rules. The rules do not recognize the capacity value of demand response, and wind and solar energy, therefore requiring consumers to buy unneeded capacity from fossil-fuel resources.

These rules are an impediment to the growth of cost-effective clean energy resources and a disservice to the 61 million customers in PJM. The Sierra Club and the other petitioners sought expedited consideration of this case so that a decision can be made in time to improve the rules before the next capacity auction is conducted in May 2017. We are optimistic that the D.C. Circuit will reverse FERC’s short-sighted decision and restore flexible market rules that recognize the capacity value of all resources at a fair price.

Further recommended reading: Jennifer Chen, Enviros, Others Sue FERC to Undo Costly Power Market Rule, Sept. 26, 2016.