Berkshire Hathaway: Make Smarter Climate Investments

Berkshire Hathaway: Make Smarter Climate Investments

Shareholders, commit to voting for 2024 shareholder resolutions that will spur smarter climate investments and enable healthier communities!

We’re asking you to vote for shareholder resolutions that will move Berkshire Hathaway away from doubling down on fossil fuels and continuing to poison and pollute communities.

Vote for Shareholder Resolution 1, requesting the creation of a report on Berkshire Hathaway Energy’s insurance-related emissions

Vote for Shareholder Resolution 2, the climate disclosure proposal filed by Illinois State Treasurer Michael Frerichs

Vote against Gregory Abel, Ajit Jain, and Sarah Decker for the Board of Directors to ensure a climate-wise Board of Directors at Berkshire Hathaway

What’s At Stake

Warren Buffett, chair and CEO of Berkshire Hathaway, is often called one of the smartest investors of all time. But his company’s failure to plan ahead for economic disruption caused by climate change is a horrible financial risk for shareholders. And worse, Berkshire Hathaway Energy is doubling down on coal and gas, raising the company’s risk.

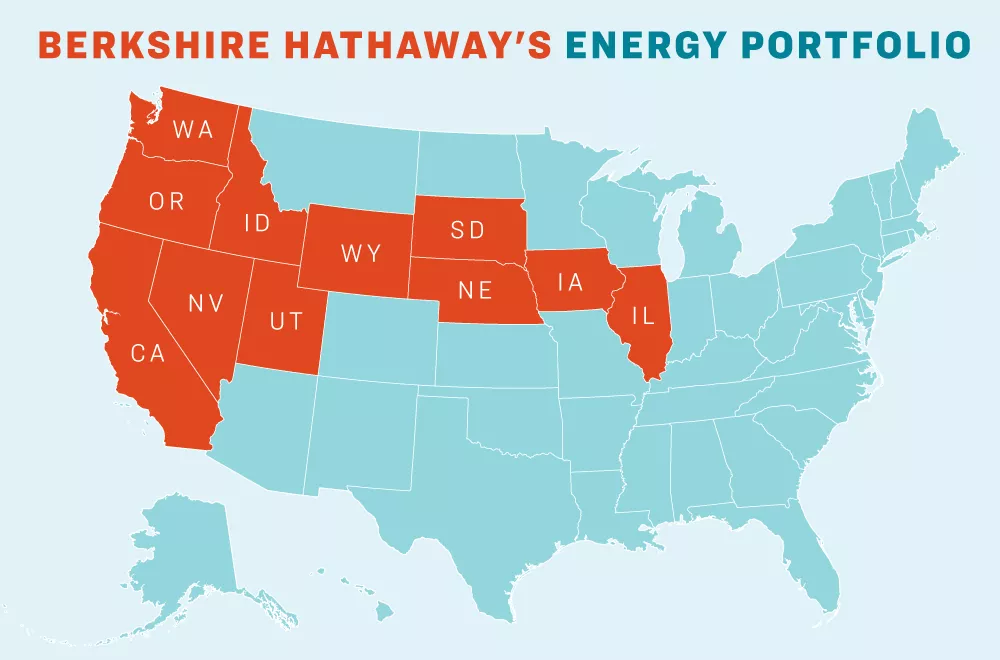

In the last two years, Berkshire Hathaway Energy’s operational negligence saddled its subsidiary PacifiCorp with a likely $2.4 billion bill for wildfire damages caused by its utility equipment in Oregon. That number may rise as the U.S. government has threatened to sue PacifiCorp for nearly $1 billion in costs related to fires in Oregon and California.

Buffett even admits these huge costs are the result of a mistake. He told shareholders that a profitable utility sector may not be possible moving forward as the public and government alike move to hold them accountable for their role in climate change: "I did not anticipate or even consider the adverse developments in regulatory returns and, along with Berkshire’s two partners at BHE, I made a costly mistake in not doing so.”

While other utilities are working to rapidly transition, Berkshire has made the choice to double-down on fossil fuels, making it the fourth largest utility emitter in the country. Its risky financial decisions continue to poison and pollute communities and expose shareholders to legal, physical, and transition risks. BHE’s largest utility, PacifiCorp, quietly brought back a coal magnate to run the utility, even as the utility asks for another rate increase to cover high fossil fuel costs. BHE’s NV Energy has continued to push for new gas infrastructure, and MidAmerican remains one of the few utilities with no transition plans for its coal-fired power plants.

Clearly, climate risk is financial risk. Berkshire Hathaway’s shareholder meeting is on May 4th. We’re calling on Berkshire to live up to its reputation and stop polluting our planet before it’s too late.