As we enter the holiday shopping season, there are more ways for consumers to save money on some big-ticket home improvement purchases that makes home healthy and protects against increasing extreme weather events. These bring savings beyond the typical Black Friday and Cyber Monday sales and luckily, they won't dry up after the decorations are taken down!

In addition to the tax credits we highlighted last year, the Inflation Reduction Act’s Home Energy Rebate Programs included $8.8 billion dollars in grant funding to help American households save money on energy bills, upgrade to clean energy equipment and improve energy efficiency, and reduce indoor and outdoor air pollution.

Rebates

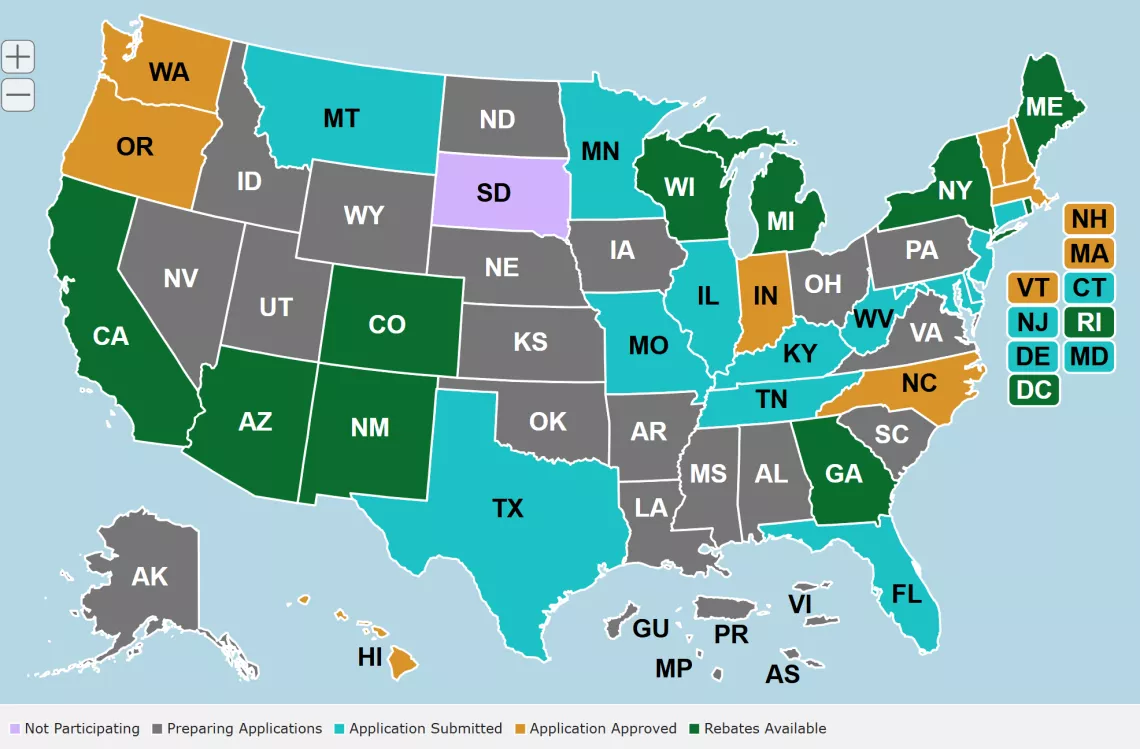

These rebates are available now for products like heat pump water heaters and clothes driers, induction stovetops, insulation, and other electrification and energy efficiency upgrades in eleven states with many more states are completing the process to make funding available for consumers. Read more about the rebate programs here. There are a range of benefits to improving the energy efficiency of a home, like saving money on utility bills and reducing energy waste. Burning fuels like gas, oil, or propane releases air pollutants that are harmful to human health and the climate.

Not only are electric appliances very energy efficient, they work really well! Have you ever seen an induction stove boil a pot of water in 3 minutes?!

Heat pumps offer valuable versatility in heating and cooling, which is not only convenient, but in some cases can even be lifesaving during increased climate change-driven heat waves in places of the country that have traditionally not needed air conditioning.

Tax Credits

Heat pumps, exterior doors and windows, and other products that reduce energy waste are also available for tax credits, thanks to the Inflation Reduction Act.

These tax credits could help consumers save 30% on the cost of their qualifying purchase -- up to $3,200 each year from now until 2032.

We put together an in-depth guide for what products are eligible for these tax credits and how you can claim them when you file your taxes. This information is all still relevant for the coming tax season.

Read the full Holiday Shopping Guide for tax credits

New Updates to Expand Savings for Consumers

The Treasury Department has continued to take comments and provide guidance to increase accessibility to tax credits and rebates.

Over the past year, the Treasury has:

- Made it easier for schools to participate and receive tax credits for clean energy projects.

- Increased the maximum rebates available for appliances in both your kitchen and laundry room.

Consumers can now receive a rebate for a qualifying kitchen appliance, like an electric stove, cooktop, range, or oven, up to $840 AND a rebate for an electric heat pump clothes dryer up to $840. Previously, rebates were capped at $840 total for either the kitchen or the laundry, but not both.

To find available rebates and tax credits in your area, visit ENERGY STAR’s Rebate Finder page. Simply type in your zip code to discover energy-efficient appliances and upgrades eligible for savings from federal, state, utility, and local programs.

Electric Vehicle Tax Credits

If you're considering purchasing a clean vehicle, you could qualify for up to $7,500 in tax credits for eligible plug-in electric and fuel cell vehicles purchased in 2023 or later. Learn more about qualifications and requirements on the IRS Clean Vehicle Tax Credit FAQ.

Understanding Tax Credits vs. Rebates

Not sure about the difference between tax credits and rebates? The Department of Energy created a 1-minute explainer video to help you understand how these incentives work and how to take advantage of them.

- Tax Credits: Reduce the amount you owe on your federal taxes.

- Rebates: Provide direct cash savings on the purchase of qualifying products.

These savings are available to homeowners, but renters can also take advantage of some of these programs, as well. Still, Sierra Club has joined our partner, Climate and Community Institute, in advocating for even more policies that include and protect renters.

Have a Clean Energy Success Story? Share it!

The U.S. Department of the Treasury wants to hear from you! If you’ve benefited from IRA tax credits or rebates to make cleaner, energy-saving purchases over the past two years, your story could help inspire others and strengthen these critical incentives.

Share how these programs have lowered costs, boosted clean energy, or created jobs in your community. Your voice is powerful for expanding access to these game-changing opportunities.

📢 Submit your story here: www.treasury.gov/ira-storytelling

Let’s highlight the real impact of clean energy investments! 🌱

With these programs, you can save money while making energy-efficient improvements to your home, reducing your utility bills, and contributing to a healthier environment. Explore the possibilities today!