Photo of gas flares in Cotulla, TX courtesy of Al Braden.

By Cyrus Reed, Legislative and Conservation Director, Sierra Club Lone Star Chapter

Texas is the leading producer of gas in the U.S. 2023 was indeed a record year, or a banner year, according to our gas “regulator,” the Texas Railroad Commission, with operators producing 12.01 trillion cubic feet of gas, beating the previous record by more than 13%.

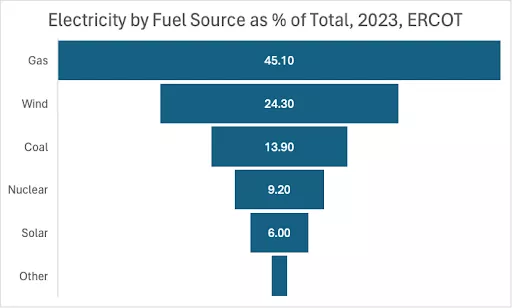

That gas serves a large number of purposes and markets, from exports through existing Liquified Natural Gas export terminals in Texas and Louisiana, to gas supplies for heating and cooking, to industrial uses and finally to gas-fueled power plants. Indeed, 2023 was also a record year for electric demand in our main electric grid known as ERCOT, the Electric Reliability Council of Texas. In 2023, we got our electricity from five major sources of power, but gas provided the most at about 45 percent of all kilowatt hours consumed, a slight increase over 2022.

The Sierra Club recognizes the role that gas and coal have historically played in meeting our electricity needs, but also recognizes that the reality of climate change demands we transition away from fossil fuels toward new ways of making power, from on-shore and off-shore wind, to solar, to battery storage, and soon geothermal power. We also recognize that we must do more to reduce energy consumption with energy savings, demand response, and distributed energy resources like onsite solar and storage. Gas is dirty, often unreliable, and comes not only with emissions of pollutants that cause climate change, but also other emissions that contribute to local air quality issues like ground-level smog formation. Depending on the type, gas power plants can also be water hogs.

Unfortunately, political leadership and many Texans seem to mistakenly believe that we must invest even more in gas power plants to meet our growing electricity needs, passing SB 2627 and a constitutional amendment (Proposition 7) in 2023, which obligates up to $10 billion for low-interest loans and bonuses for “dispatchable” power plants within ERCOT. In addition, two new mechanisms being developed by ERCOT and the PUCT seem designed to provide even more incentives to existing and potential future gas plants. Recently, two major entities – Vistra Energy and Entergy Texas – both essentially said they are betting their future on burning more climate-warming gas.

The Prop 7 boondoggle

The Texas legislature passed SB 2627, which was signed into law by Governor Abbott in 2023. That law came with a constitutional amendment known as Prop 7, which was approved by voters in November of 2023. Those two pieces of legislation authorized and required the Public Utility Commission of Texas (PUCT) to approve rules for the new “Texas Energy Fund,” including a 3% low-interest loan program for “dispatchable” power plants that were at least 100 Megawatts in size. Earlier this year, the PUCT approved the rule, hired a third-party administrator, and opened up the Fund for applications.

In May, the PUCT required any developer to submit an initial Notice of Intent to apply and the results were staggering. The PUCT received at least 125 notices of intent (NOI) to apply for a loan through the Texas Energy Fund’s In-ERCOT Generation Loan Program. In total, the notices requested more than $38.9 billion in financing for 55,908 megawatts of proposed dispatchable power generation projects for the Electric Reliability Council of Texas (ERCOT) region. Some of the proposals were very much expected, like three proposed plants owned by NRG that are essentially additions to existing power plants in the Houston area.

But beyond the traditional names like NRG and Calpine were other new participants, including some very large combined cycle plants, and even a few that said their intent was to build “hydrogen” plants, or at least transition to hydrogen fuel when it became available. Even some public entities like CPS Energy, Kerrville Public Utility Board, and Greenville Electric Utility Service submitted notices of intent. You can see the full list of applicants here, but the information about the proposals is very limited. Presumably once these entities submit formal proposals more specifics will be available. It’s hard to tell from the list which are “serious” proposals and which are very speculative or even meet the requirements of the program.

In response to the slew of gas proposals, Dave Cortez, the Director of the Sierra Club Lone Star Chapter, issued the following statement:

“Socialized corporate welfare for politicians’ fossil fuel-tycoon donors to build more climate-warming, unreliable gas plants is not the answer to a grid crisis driven by climate change.

“The truth is that gas has failed us when we needed it most; the lifecycle of gas can release more climate-warming emissions than a coal plant; and drilling, fracking, and flaring are polluting communities’ air and water from the Permian to East Texas.

“Meanwhile, our people are also facing record-breaking summer heat with trepidation, and several regions of Texas are still cleaning up from near-constant storms.The last three weeks in Texas have shown that Mother Nature bats last: tornados, extreme heat, derechos, and high winds dismantle housing and energy infrastructure.

“Texans need help being safe in our homes when the lights will inevitably go dark. Texans need more resilience hubs such as cooling and heating centers for underserved communities so they can survive the next blackout. We need to reduce demand on the grid by making buildings more energy efficient, and we need to invest more in local and distributed energy systems like rooftop solar and battery storage so the grid can be more flexible. Steel in the ground alone is an outdated tool. Our climate has changed, no matter how much fossil fuel-funded Texas politicians deny it. And every gas plant that greedy CEOs build with our tax money pumps out pollution that only worsens extreme weather.”

Vistra and Entergy signal their intent to go gas heavy

Two large private corporations also announced their intent to build new gas facilities separate from the publicly available funds. Vistra, the largest generator in Texas through their subsidiary Luminant, announced they plan to add about 2,000 MWs of gas-fired power plants. Vistra's plan includes 860 MW of simple-cycle peaker plants to be located in West Texas, a conversion of Vistra's coal-fueled Coleto Creek Power Plant to a gas-fueled plant, enabling up to 600 MW of additional capacity, and upgrades of existing gas plants that will add more than 500 MW of summer capacity and 100 MW of winter capacity.

In their announcement, they made clear that these investments were dependent on several market reforms still being implemented including a reliability standard, a Performance Credit Mechanism and a Dispatchable Reliability Reserve Service.

Outside of ERCOT, Entergy Texas, which serves parts of Southeast Texas, doubled down on gas as its future, announcing a strategic plan known as “STEP Ahead.” The Southeast Texas Energy Plan, also known as STEP Ahead, released on May 30th, commits Entergy Texas to build an additional 1,600 MW of generation capacity by 2028. While the plan is short on details, it appears that all of the generation would be gas, but designed in a way to include carbon capture or conversion to hydrogen in the future. Entergy Texas filed its first set of proposals for STEP Ahead in early June, which will require approval from the PUCT. The company plans to announce additional details regarding the next set of proposals in the coming months. What is amazing about the announcements is that Entergy appears to only be considering gas and/or hydrogen, and is not considering battery storage, or solar, or programs to reduce demand.

DRRS and PCM - designed to pay gas plants?

At the heart of the bet on gas by many companies is that the PUCT and ERCOT will soon approve new rules that will provide extra incentives for gas plants. First, the PUCT is expected to approve a new “reliability standard” by August. If it is developed in a way that is very conservative, it will mean the PUCT and ERCOT could be required to contract for more reserve services to meet the standards, and those reserves are most likely to be gas units. For example, under legislation passed in 2023, ERCOT is required to develop a new “Dispatchable Reliability Reserve Service,” or DRRS. While Sierra Club was supportive of the need for a new service, our support was contingent on the service being technologically neutral and available for any resource – gas, storage or even load reduction – able to provide the service to be paid. However, ERCOT just released a version that only includes off-line generators as being eligible to provide the service, meaning larger gas or even coal resources. Sierra Club is working through the stakeholder process to make changes to the draft rule, or protocol.

Of more interest is the Performance Credit Mechanism (PCM), which has yet to be developed through the PUCT and ERCOT process. While the legislature put some guardrails on the cost of the service, an initial version of the proposed mechanism for dispatchable resources was again written in a way that heavily favored gas resources at a hefty price for consumers. Again, the service will not be developed for several years, but gas investors are counting on consumers paying for the capacity they are developing through this subsidy.

But isn’t the market moving away from gas and coal and toward solar and storage?

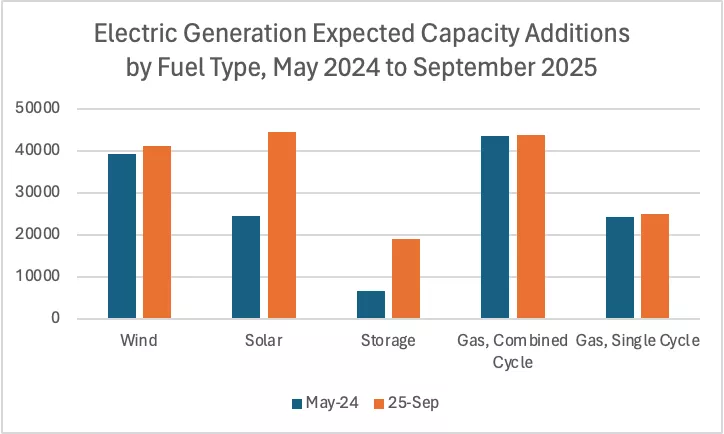

Yes, at least until these recent announcements and mechanisms to insert state money and incentives into our market, the energy-only market was showing a strong predilection toward solar and storage. Every month ERCOT publishes both a Generation Interconnection Status Report (GIS) and a Resource Capacity Trend Report. While the GIS includes both short-term and longer-term projects, the trends report looks only at the next 18 to 24 months and thus is a bit more accurate about what new resources might be coming. Both reports show overwhelming movement toward more solar and storage investments.

Source: ERCOT, Capacity Changes by Fuel Type, April 2024, available at https://www.ercot.com/gridinfo/resource, May 2024.

The charts show that the projects that already have interconnection agreements with local transmission companies that are most likely to be built in the next 18 months are solar and battery storage with only a handful of new gas plants likely to be added. However, the passage of Proposition 7, along with the potential addition of DRRS and especially a PCM in perhaps 2026 make it likely that more gas plants – especially gas turbines – are likely to be built. While many of the projects that submitted a “Notice-of-Intent” to the PUCT are very unlikely to be built, many will likely move forward with an application in July with the PUCT and receive a taxpayer subsidy through a low interest rate and eventually may be eligible for an additional subsidy through a performance bonus.

During 2021’s winter storm and other climate extremes, gas proved to be "disproportionately vulnerable to failure" precisely when we need it the most. And even though Texas passed new rules requiring improvements in gas infrastructure weatherization, it's not clear that they’ve been effective. Betting on gas is risky and expensive and continues a commitment to burning fossil fuels. Gas prices go up and down, and as our energy market is gas-heavy, any rise in gas prices makes its way to home electric bills. Beyond cost, as the top user and producer of electricity, the U.S. cannot meet our goal to decarbonize our economy if we are investing heavily in gas.

The Sierra Club will continue to fight everyday at ERCOT and the PUCT to bring sane and fair policies that protect consumers' pocket-books and help enable a transition toward a more stable and less polluting electric grid. Will we fight every new gas power plant? Realistically no, but we will be looking at the required air permit, location, and other information and assessing options to oppose specific plants. And no matter what, we will continue to fight for the PUCT, ERCOT, and the legislature to pay attention to the demand-side and programs to help consumers afford rising electric prices in Texas.