Earlier this month, our independent electric grid operator, the Electric Reliability Council of Texas (ERCOT), released two reports which predicted record summer electricity use and potentially low reserves. In fact, ERCOT stated that it may need to rely on out-of-market solutions to meet our energy demand this summer as well as voluntary conservation measures and the use of “Energy Emergency Alerts” (EEA) (essentially, the use of contracted smaller back-up generators and demand response programs to lower energy use at peak times).

Should Texas be worried, or concerned about rolling brown-outs or even black-outs? Will summer energy prices skyrocket? Long term does our energy outlook seem healthy?

First The Facts

As required by their rules, twice a year ERCOT releases its longer-term Capacity, Demand and Reserves (CDR) Report, as well as its shorter-term Seasonal Assessment of Resource Adequacy (SARA). This year, its May SARA found that our expected summer peak demand -- assuming an “average” hot summer -- would hit 74,853 megawatts (MW) -- while our total supply would only be 78,893 MW, meaning a reserve margin of only 8.6%. Interestingly, this reserve capacity is slightly higher than an earlier prediction, in large part because about 365 MW of natural gas units that were mothballed are expected to come back online and return to the market.

In addition, since the last 2018 CDR in December, approximately 733 MW of installed wind and solar capacity has been approved by ERCOT for commercial operations, with summer peak capacity contributions of 333 MW. ERCOT is also starting to count smaller-scale distributed generation solar units, and they have estimated that 22 units will contribute 106 MW of summer peak.

Will there be rolling black outs?

While it is very hard to predict, ERCOT believes that they will have sufficient capacity to meet our needs, and if reserves get too tight, they have both “normal” ancillary reserves and contracts with the EEA services to meet needs. What is worrisome to ERCOT is the high energy demand in West Texas -- spurred primarily by oil and gas demand -- as well as new facilities coming into service along the Coast. And of course continued population growth.

While the average amount of electricity used by people in Texas is falling, with population and industrial growth, both peak energy and overall energy use continue to rise. With these tight reserves, it is quite likely that real-time energy prices will rise significantly this summer, even though many energy consumers will not be impacted because of long-term contracts.

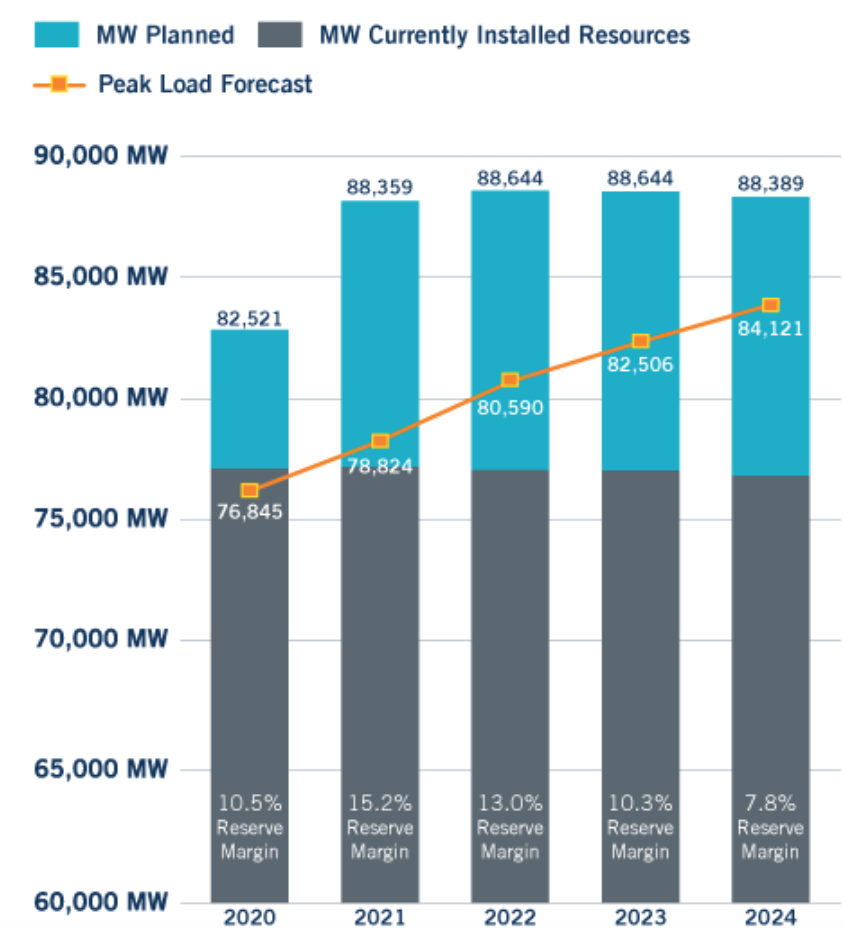

But the future looks... brighter

Even as the summer energy reserves are expected to be tight, ERCOT is predicting that reserves will rise in the next several years, largely because of the addition of new resources that are overwhelmingly from wind, solar, and batteries (energy storage). The CDR adds 5,267 MW of planned utility-scale solar, 1,814 MW of West Texas wind, 1,079 MW of coastal wind, and 517 MW of battery storage. While some new natural gas is also planned (about 2,000 MW) the CDR clearly shows that wind, solar, and batteries will become the preferred investments in Texas’s future electricity use. With these additions, ERCOT shows our reserve margin climbing above 10 percent between 2020 and 2023.

The ERCOT queue looks even better. According to the April 2019 ERCOT Generation Interconnection Request Report, there are currently some 100,000 MW of proposed power plants being considered, including 10,000 MW of natural gas, 3,500 MW of batteries, 55,000 MW of solar and 35,000 MW of wind. While the vast majority of these proposals may never be constructed, the long-term trends in ERCOT are to invest in clean energy options like wind, solar, and battery storage. This cleaner supply, coupled with investments in energy efficiency and demand response, should allow Texas to continue to meet our growing electricity demand.

Source: ERCOT, May 08, 2019, “ERCOT expects record electric use, increased chance of energy alerts”