How a Massive "Green Smelter" Could Kick-Start Kentucky's Clean Energy Economy

An enormous new plant would be the nation's first in 45 years

Photo by Alfa Studio/iStock

This article was originally published by Canary Media.

ASHLAND, Kentucky—When John Holbrook first started working as a pipefitter in the early 1990s, jobs were easy to come by in his corner of northeastern Kentucky.

A giant iron and steel mill routinely needed maintenance and repair work, as did the coal “coking” ovens next to it. There was also a hulking coal-fired power plant and a bustling petroleum refinery nearby. Fossil fuels extracted from beneath the region’s rugged Appalachian terrain supplied these industrial sites, which sprung up during the 19th and 20th centuries along the yawning Ohio River and its tributary, Big Sandy.

“Work was so plentiful,” Holbrook recalled on a scorching August morning in Ashland, a quiet riverfront city of some 21,000 people.

Ashland retains its motto as the place “Where Coal Meets Iron,” and railcars still rumble by. But after years of downsizing production, the steel mill’s owner demolished the complex in 2022. A decade ago, the coal plant switched to burning natural gas to generate electricity, which requires less hands-on maintenance. Meanwhile, thousands of jobs vanished from surrounding coalfields as mining became more mechanized, market forces shifted, and clean air policies took hold.

Many families have since moved away. The tradespeople who’ve stayed often drive for hours to work on the new construction projects sprouting up in other places, like the massive factories for making and recycling electric-car batteries in western Kentucky and the electricity-powered steel furnace in neighboring West Virginia. If America is undergoing a manufacturing boom, it hasn’t yet reached this hard-hit stretch of the Bluegrass State.

But that could soon change.

In March, Century Aluminum, the nation’s biggest producer of primary, or virgin, aluminum, announced that it plans to build an enormous plant in the United States—the nation’s first new smelter in 45 years. Jesse Gary, the company’s president and CEO, has pointed to northeastern Kentucky as the project’s preferred location, though he said there were still a “myriad of steps” before the company reaches a final decision.

The Chicago-based manufacturer is slated to receive up to $500 million in funding from the U.S. Department of Energy to build the facility, which could emit 75 percent less carbon dioxide than traditional smelters, thanks to its use of carbon-free energy and energy-efficient designs. The award is part of a $6.3 billion federal program—funded by the Inflation Reduction Act and the Bipartisan Infrastructure Law—that aims to sharply reduce greenhouse gas emissions from heavy-industry sectors.

The Ohio River seen from Ashland, Kentucky. | Photo by Maria Gallucci

John Holbrook at his office in Ashland. | Photo by Maria Gallucci

Aluminum demand is set to soar globally by up to 80 percent by 2050 as the world produces more solar panels and other clean energy technologies. The makers of the essential material are now under mounting pressure from policymakers and consumers to clean up their operations. In North America alone, aluminum producers will need to cut carbon emissions by 92 percent from 2021 levels to meet net-zero climate goals.

Century already owns two aging smelters in western Kentucky. The new “green smelter” is expected to create over 5,500 construction jobs and more than 1,000 full-time union jobs. If built in eastern Kentucky, the $5 billion project would mark the region’s largest investment on record.

“We just need a crumb or two, just a little giant smelter,” Holbrook said with a laugh when we met at his office near Ashland’s historic main street. A short walk away, stones used in the city’s original iron-making furnaces stand as monuments overlooking the Ohio River.

Today, Holbrook heads the Tri-State Building and Construction Trades Council, which represents unions in a cluster of adjoining counties in Kentucky, Ohio, and West Virginia. He’s part of a broad coalition of labor organizers, local officials, environmentalists, and clean energy advocates who are urging Kentucky Governor Andy Beshear (D) to work with Century to secure the smelter and hammer out a long-term deal to provide clean energy for it.

“It’d be a godsend for that area,” said Chad Mills, a pipefitter and the director of the Kentucky State Building and Construction Trades Council. The region “needs it more than you can imagine.”

The impact of Century’s new smelter would ripple far beyond this rural stretch of verdant peaks and meandering creeks.

The planned facility is set to nearly double the amount of primary aluminum that the United States produces—helping to revitalize a domestic industry that has been steadily shrinking for decades owing to spiking power prices and increased competition from China. In 2000, U.S. companies operated 23 aluminum smelters. Today, only four plants are operating, while another two have been indefinitely curtailed. That includes Century’s 55-year-old plant in Hawesville, Kentucky, which has been idle since June 2022.

Illustration by Binh Nguyen/Canary Media

The decline in U.S. production has complicated the country’s efforts to both make and procure lower-carbon aluminum for its supply chains, experts say.

Globally, the aluminum sector contributes around 2 percent of total greenhouse gas emissions every year. Nearly 70 percent of those emissions come from generating high volumes of electricity—often derived from fossil fuels—to power smelters almost around the clock.

As U.S. primary production dwindles, the country is importing more aluminum made in overseas smelters that are powered by dirtier, less efficient electrical grids. Ironically, an increasing share of that aluminum is being used to make solar panels, electric cars, heat pumps, power cables, and many other clean energy components. The metal is lightweight and inexpensive, and it’s a key ingredient in global efforts to electrify and decarbonize the wider economy.

But aluminum is also mind-bogglingly ubiquitous outside the energy sector. The versatile material is found in everything from pots and pans, deodorant, and smartphones to car doors, bridges, and skyscrapers. It’s the second-most-used metal in the world after steel.

Last year, the U.S. produced around 750,000 metric tons of primary aluminum while importing 4.8 million metric tons of it, according to the U.S. Geological Survey.

Meanwhile, the country produced 3.3 million metric tons of “secondary” aluminum in 2023. Boosting recycling rates is seen as a necessary step for addressing aluminum’s emissions problem, because the recycling process requires about 95 percent less energy than making aluminum from scratch. But even secondary producers need primary aluminum to “sweeten” their batches and achieve the right strength and durability, said Annie Sartor, the aluminum campaign director for Industrious Labs, an advocacy organization.

“Primary aluminum is essential, and we have a primary industry that’s been in decline, is very polluting, and is very high-emitting,” Sartor said. Century’s proposed new smelter “could be a turning point for this industry,” she added. “We all would like to see it get built and thrive.”

A new green smelter wouldn’t just boost supplies of primary aluminum for making clean energy technologies. The facility, with its voracious electricity appetite, is also expected to accelerate the region’s buildout of clean energy capacity, which has lagged behind that of many other states.

Century expects its planned smelter to produce about 600,000 metric tons of aluminum a year. That means it could need at least a gigawatt’s worth of power to operate annually at full tilt, equal to the yearly demand of roughly 750,000 U.S. homes. By way of comparison, Louisville, Kentucky’s largest city, is home to some 625,000 people.

But Kentucky has very little carbon-free capacity available today.

About 0.2 percent of the state’s electricity generation came from solar in 2022, while 6 percent was supplied by hydroelectric dams, mainly in the western part of the state. Coal and gas plants produced most of the rest. Still, after decades of clinging tightly to its coal-rich history, Kentucky is seeing a raft of new utility-scale solar installations under development, including atop former coal mines.

And manufacturers in Kentucky can access the renewable energy being generated in neighboring states as well as regional grid networks like PJM. Swaths of eastern Kentucky are covered by a robust array of high-voltage, long-distance transmission lines operated by Kentucky Power, a subsidiary of the utility giant American Electric Power.

Photo by Maria Gallucci/Canary Media

Lane Boldman, executive director of the Kentucky Conservation Committee, said that investing in clean energy and upgrading grid infrastructure would offer a chance to employ more of Kentucky’s skilled workers.

“It’s exciting, because it actually modernizes our industry and leverages a local workforce that has a great expertise with energy already,” she said when we met in Lexington, near the rolling green hills and long white fences of the area’s horse farms. “There are ways you can create economic development that are not so extractive, that just leave the community bare.”

Northeastern Kentucky isn’t the only location that Century is considering for the smelter. The company is also evaluating sites in the Ohio and Mississippi river basins. The final decision will depend on where there’s a steady supply of affordable power, a Century executive told The Wall Street Journal in early July. (A spokesperson didn’t respond to Canary’s repeated requests for comment.)

Century is aiming to secure a power-supply deal to meet a decade’s worth of electricity demand from the new smelter, according to the Journal. The goal is to finalize plans in the next two years and then begin construction, which could take around three years. In the meantime, the U.S. will continue to see a rapid buildout of solar, wind, and other carbon-free power supplies connecting to the grid.

Governor Beshear has participated in discussions about the smelter’s power supply, in the hopes of landing Century’s megaproject and all of its “good-paying jobs.” His administration “continues to work with multiple experts to determine a location in northeastern Kentucky that includes a river port and can support workforce training as well as provide the cleanest, most reliable electric service capacity needed,” Crystal Staley, a spokesperson for the governor’s office, said by email.

Environmental advocates say the aluminum plant represents a chance to reimagine what a major industrial facility can look like: powered by clean energy, equipped with modern pollution controls, and built with local community input from the beginning. Starting sometime this fall, the Sierra Club is planning to host public meetings and distribute flyers in northeastern Kentucky to let residents know about the giant smelter that could potentially be built in their backyards.

“It’s an opportunity for us to engage people who might shy away from other aspects of being an environmental activist and say, ‘Hey, this is something that we can embrace, because it’s going to help us create jobs so that people can stay in their region,’” said Julia Finch, the director of Sierra Club’s Kentucky chapter. “This is a chance for us to lead on what a green transition looks like for industry.”

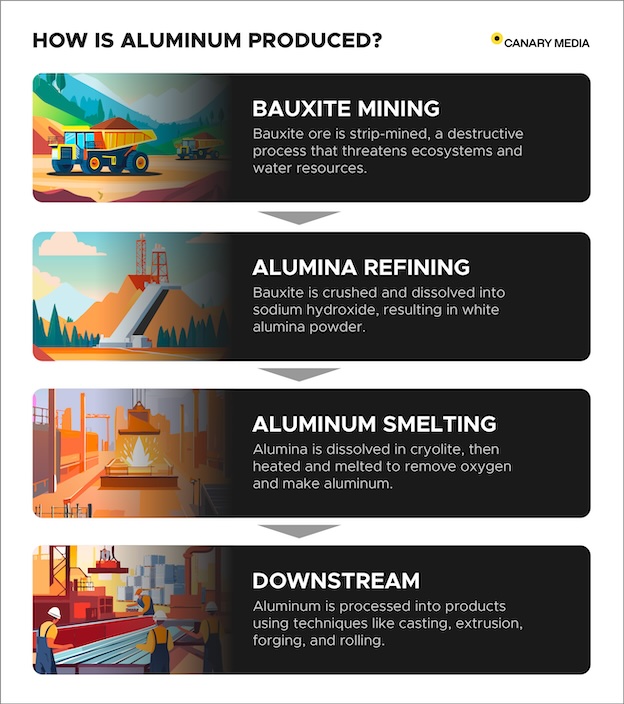

Aluminum is the most abundant metal in Earth’s crust. But turning it into a sturdy, usable material is a laborious and dirty process—one that begins with scraping topsoil to extract bauxite, a reddish clay rock that is rich in alumina (also called aluminum oxide). The trickiest part comes next: removing oxygen and other molecules to transform that alumina into aluminum. Until the late 19th century, the methods for accomplishing this were so costly that the tinfoil we now buy at the grocery store was considered a precious metal, like gold, silver, and platinum.

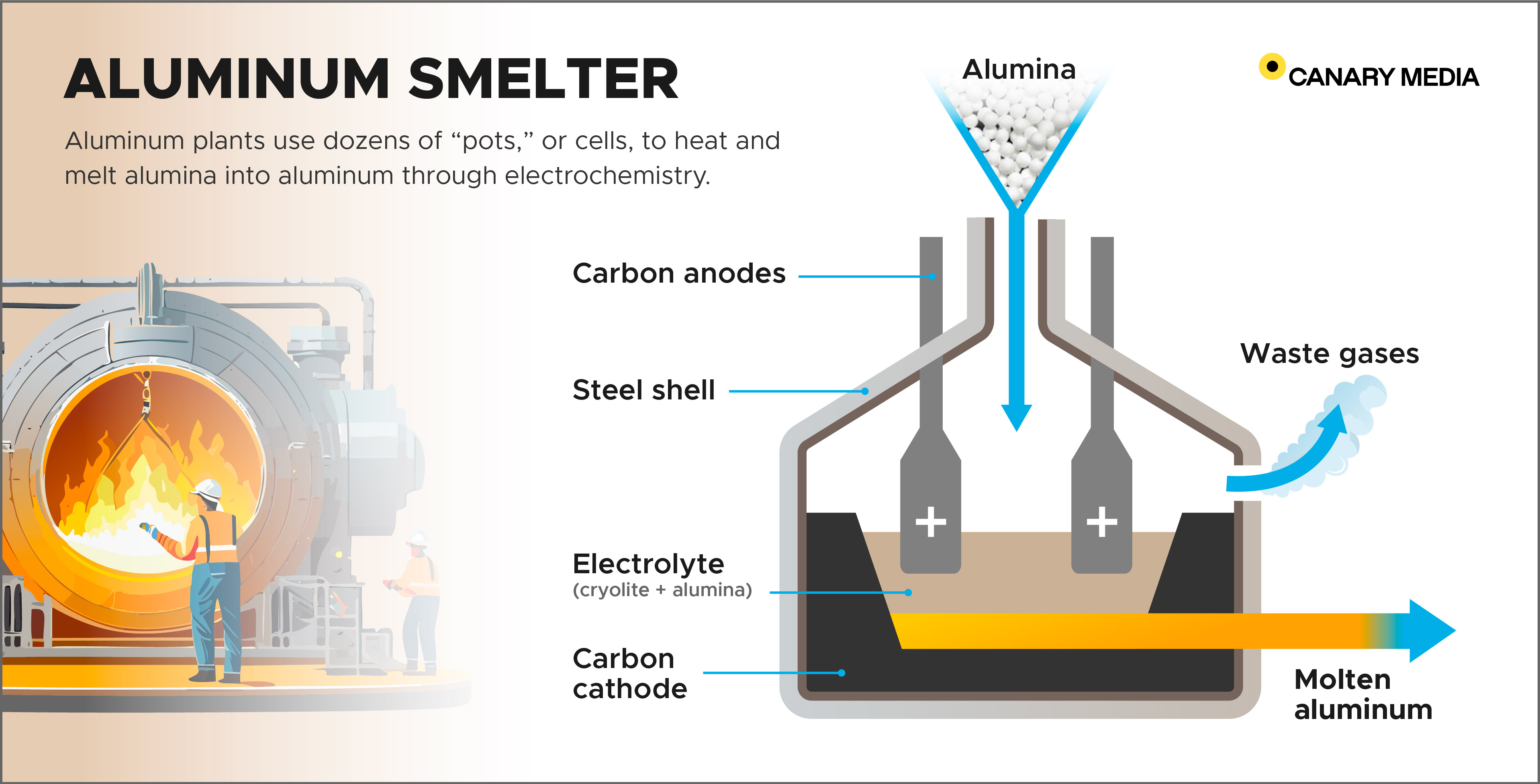

Then in 1886, Charles Martin Hall figured out an inexpensive way to smelt aluminum through electrolysis, a technique that uses electrical energy to drive a chemical reaction. Not long after, he helped launch the Pittsburgh Reduction Company, which went on to become the U.S. aluminum behemoth presently known as Alcoa.

Around the same time that Hall was tinkering in his woodshed in Oberlin, Ohio, a French inventor named Paul Louis Touissant Héroult was making a similar discovery in Paris. Modern aluminum smelters now use what’s called the Hall-Héroult process—an effective but also energy-intensive and carbon-intensive way of making primary aluminum metal.

Smelting involves dissolving alumina in a molten salt called cryolite, which is heated to over 1,700 degrees Fahrenheit. Large carbon blocks, or “anodes,” are lowered down into the highly corrosive bath, and electrical currents run through the entire structure. Aluminum then deposits at the bottom as oxygen combines with carbon in the blocks, creating carbon dioxide as a byproduct.

The Martin County Solar Project spans 900 acres on the old Martiki mine site in Pilgrim, Kentucky. | Photo by Edelen Renewables.

Today, this electrochemical process contributes about 17 percent of the total CO2 emissions from global aluminum production. It also causes the release of perfluorochemicals (PFCs)—potent and long-lasting greenhouse gases—as well as sulfur dioxide pollution, which can harm people’s respiratory systems and damage trees and crops. In 2021, PFCs accounted for more than half the emissions from Century’s Hawesville smelter and a third of the emissions from its Sebree smelter in Robards, Kentucky, according to the Sierra Club.

Newer smelters can dramatically reduce their PFC emissions by using automated control systems, which Century deploys at its smelter in Grundartangi, Iceland. Researchers are also working to slash CO2 by developing carbon-free blocks. The technology involves using chemically inactive, or “inert,” metallic alloys in the anodes through which the electrical currents flow. Elysis, a joint venture of Alcoa and the mining giant Rio Tinto, says it is making progress toward the large-scale implementation of its inert anodes and has plans for a demonstration plant in Quebec.

The alternative anodes may not be ready in time for a project like Century’s planned green U.S. smelter. Previously, large-scale buyers of aluminum, such as automakers and construction companies, had anticipated that inert anodes would help slash CO2 emissions in the aluminum supply chain in time for companies to meet their 2030 climate goals. But now that’s looking less likely.

“There’s a feeling now that it’s just taking longer to develop that technology,” said Lachlan Wright, a manager of the climate intelligence program at RMI, a clean energy think tank. One challenge might simply be the limited production capacity for the new anodes, which can’t yet meet the demands of a large aluminum user. Beyond that, “It’s not exactly clear what some of the barriers are there,” Wright added.

Still, when it comes to tackling aluminum’s biggest CO2 culprit—all the electricity it takes to run a smelter—the solutions already exist, in the form of renewable energy and other carbon-free sources.

“We don’t need a new or emerging technology,” Sartor said. “We need huge amounts of existing technology, and it needs to be available in places that work for the industry.”

Deep in the heart of Kentucky’s coal country, the scarred and treeless lands of former surface mines are increasingly being repurposed to supply that clean energy.

On another sun-blasted day in early August, I met with Mike Smith in Hazard, a city of some 5,300 people that’s enveloped by the Appalachian Mountains and built along the winding curves of the North Fork Kentucky River.

We hopped in his white pickup truck and headed toward his family’s 800-acre property. For years, they leased the land to Pine Branch Mining, which dynamited the mountaintop to reach coal seams buried beneath the surface. “I can’t say that I was for it,” Smith told me as we drove past modest homes tucked into creekside hollers and up a bumpy gravel road. Today, he said, “the only coal that’s left here is under the river.”

After the mine closed a decade ago, the land was reclaimed: smoothed out, packed down, and covered with vegetation to prevent erosion. Now, the property is about to undergo its latest transformation, as the home of the 80-megawatt Bright Mountain Solar facility.

Avangrid, the lead developer, plans to begin installing solar panels here next year, according to Edelen Renewables, the project’s local development partner. Edelen is also helping to advance other “coal-to-solar” projects in the region, including the 200 MW Martin County Solar Project under construction as well as BrightNight’s 800 MW Starfire installation. Rivian, the electric-truck maker, has signed on as the anchor customer for the $1 billion Starfire project, which is in the early stages of development.

Building on old mining sites can be more expensive and logistically trickier than, say, putting panels on flat, solid farmland. For one, hauling equipment to the former mines requires driving big, heavy vehicles up narrow mountain roads. Smith’s site is divided into uneven tiers of unpaved land. On our visit, he expertly accelerated his truck up a steep dirt path. When we reached the top, I audibly exhaled with relief. Smith gently laughed.

Despite the challenges, there’s an obvious poetry to building clean energy in a place that once yielded fossil fuels. Ideally, it can also bring justice to communities that are still hurting economically and spiritually from the coal industry’s inexorable decline. Bright Mountain and other coal-to-solar developments are projected to generate millions of dollars in local tax revenue over their lifetimes, using land that was left unsuitable for anything other than cattle grazing.

“You’ve got to reinvent yourself,” Smith told me as we gazed at the empty expanse of land where the solar project will eventually stand. Dragonflies darted by, and a quail called from somewhere on the property. “That’s the only way we can survive.”

The next day, I met Adam Edelen, the founder and CEO of Edelen Renewables, at his office in downtown Lexington. Sitting in a wicker rocking chair and sipping a pint glass of sweet tea, Edelen lamented the years of “outright hostility” to renewable energy development in the state. However, some Kentucky policymakers are starting to recognize the need to clean up the state’s electricity sector—if not explicitly to tackle climate change, then at least to attract manufacturers like Century Aluminum that want to power their operations with carbon-free energy sources.

“Now, we’re in this headlong rush to make sure we’ve got a diversified energy portfolio to meet the needs of the private sector,” Edelen said. For Century in particular, he added, “The issue is that they need cheap power and they need green energy, neither of which Kentucky has a lot of.”

Electricity accounts for about 40 percent of a smelter’s total operating expenses. To remain cost competitive, aluminum producers need to hit a “magic benchmark” of around $40 per megawatt-hour, said Wright of RMI. Currently, power-purchase agreements for U.S. renewable energy projects are in the range of $50 to $60 per megawatt-hour—a significant difference for facilities that can consume 1 megawatt-hour of electricity just to produce a single metric ton of aluminum.

Provisions in the Inflation Reduction Act could help to narrow that price gap for Century and other primary aluminum makers.

Construction on the Martin County Solar Project began in 2023 and is slated to be completed later this year. | Photo by Edelen Renewables

The 45X production tax credit is a keystone of the IRA, which President Joe Biden signed into law two years ago. The incentive allows producers of critical materials, solar panels, batteries, and other types of “advanced manufacturing” products to receive a federal tax credit for up to 10 percent of their production costs, including electricity.

The IRA also set aside another $10 billion for the 48C investment tax credit, an Obama-era program that’s now available to help manufacturers install equipment that reduces emissions by 20 percent. Aluminum producers could use the tax credit to cover the cost of technology that improves their operating efficiency while also slashing CO2 pollution.

Edelen Renewables says the 48C tax credit will apply to all the coal-to-solar projects, which the company hopes can supply some of the electricity needed for Century’s green smelter. Under the expanded program, renewable energy projects built in “energy communities,” including former coal mine sites, can receive tax credits worth up to 40 percent of project costs, significantly lowering the final cost of electricity associated with the installations.

Eastern Kentucky “has played such a vital role in powering the country’s economy for the last 100 years,” Edelen said. Coal communities “deserve a place in the newer economy, and they’re hungry for that.”

Over in Ashland, John Holbrook said he’s anxiously watching to see if northeastern Kentucky will find its place in the nation’s green industrial transition. If Century selects the region to host its new aluminum smelter, the area’s trade councils and union apprenticeship programs will be more than ready to start training and recruiting workers, he said.

But Holbrook and other local labor leaders aren’t holding their breath. Several people I spoke to recalled the elation they felt in 2018 when the company Braidy Industries broke ground near Ashland on a $1.5 billion aluminum rolling mill—and the heartbreak that followed years later when Braidy backtracked on the plant and its promise of hundreds of jobs. Braidy’s former CEO was later accused of misleading the company’s board members, state officials, and journalists about the project’s true financial status.

While the Braidy scandal was a unique affair, the fallout still lingers in discussions about Century’s green smelter. “I think they’d have to start moving trailers in before we’d feel confident to start saying, ‘Yeah, this is really happening,’” Holbrook said from behind his wide wooden desk.

Still, he remains “cautiously optimistic” about the prospect of Century building its aluminum plant here. “It would be region-changing,” he said. “And life-changing.”

Maria Gallucci is a senior reporter at Canary Media. She covers emerging clean energy technologies and efforts to electrify transportation and decarbonize heavy industry.

The Magazine of The Sierra Club

The Magazine of The Sierra Club