Biden Suggests a Windfall Profits Tax on Fossil Fuel War-Time Profiteering

What a proposed tax on excessive oil profits would do

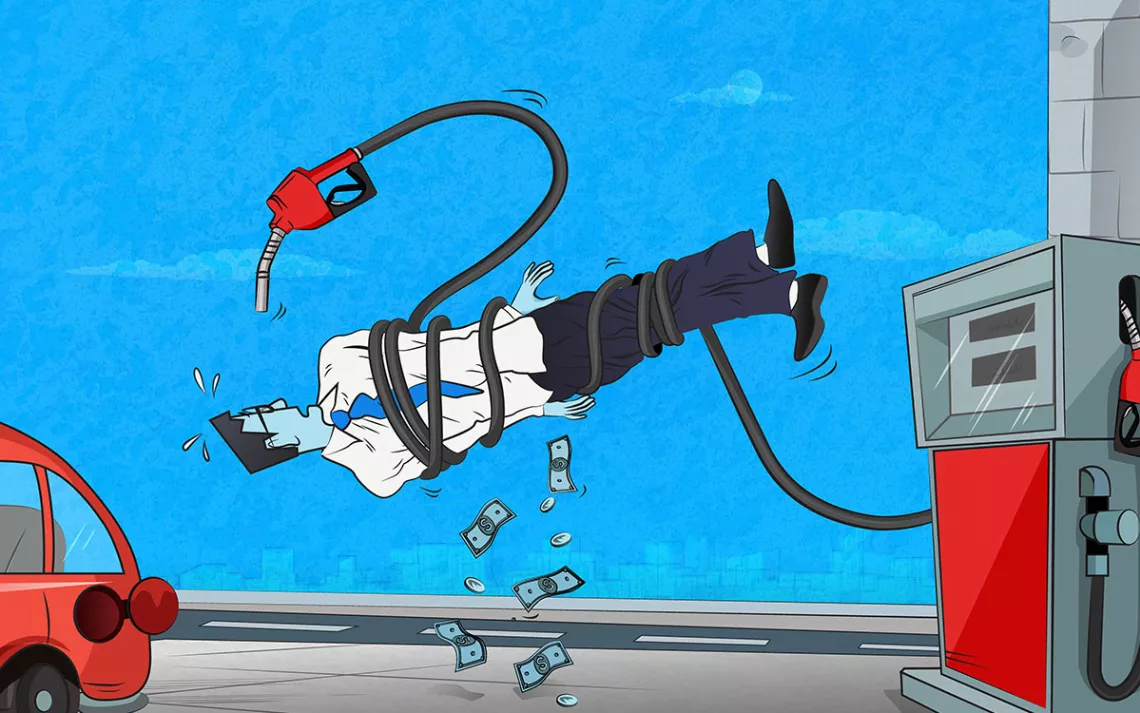

Illustration by Cemile Bingol/iStock

Earlier this week, President Biden issued his biggest challenge to date to the power and privilege of Big Oil.

During a White House speech on Monday, Biden proposed to tax the world’s largest oil and gas companies that are posting eye-watering profits as a result of the war in Ukraine and the related global energy crisis.

“Oil companies’ record profits today are not because they’re doing something new or innovative. Their profits are a windfall of war — the windfall from the brutal conflict that’s ravaging Ukraine and hurting tens of millions of people around the globe,” Biden said on Monday. “You know, at a time of war, any company receiving historic windfall profits like this has a responsibility to act beyond their narrow self-interest of its executives and shareholders.”

The oil industry’s profits have ballooned since the start of Russia’s invasion of Ukraine, which has sent global energy prices skyrocketing. ExxonMobil earned nearly $20 billion in the third quarter alone. During that period Chevron earned $11.2 billion, and Shell and BP took in $9.5 billion and $8.2 billion, respectively. In the last two quarters, ExxonMobil, Chevron, Shell, BP, ConocoPhillips, and French oil giant TotalEnergies have earned close to $100 billion combined.

President Biden framed the proposal as a way to lower gasoline prices at the pump, evidently in an attempt to appeal to voters as they head to the polls next Tuesday. Already, there are several bills introduced in Congress that would address the fossil fuel corporations’ huge profits. The legislative proposals take various forms, but the general concept boils down to taxing the profits of energy companies above some threshold deemed to be excessive — compared to profits from a prior year, for example, or a tax applied per barrel of production — and then returning the proceeds to consumers.

“This is exactly the type of leadership we’ve been waiting for from President Biden,” said Jamie Henn, spokesperson for the group ‘Stop the Oil Profiteering.’ “Big Oil has made nearly $300 billion in excess profits this year by gouging us at the pump. A windfall profits tax can provide immediate relief by redirecting that money into the pockets of hardworking Americans.”

Representative Ro Khanna, a Democrat from California, and Senator Sheldon Whitehouse, a Rhode Island Democrat, proposedwindfall profits tax legislation earlier this year, and they applauded President Biden’s move. “I was delighted to see it and I thought the narrative of wartime profiteering was particularly strong and helpful,” Senator Whitehouse said in public remarks at a Twitter Space event on Tuesday. The oil industry has “just gone on a splurge of gouging consumers,” he added.

Predictably, business groups, oil executives and oil lobbyists denounced the move, warning that it would discourage drilling and lead to higher gasoline prices.

But that appears a hollow argument, given the fact that the oil companies are not, in fact, prioritizing using their windfall for drilling, and instead are showering investors with their mountains of cash. ExxonMobil, Chevron, Shell, and TotalEnergies are sending roughly $100 billion to shareholders annually in the form of buybacks and dividends while putting $80 billion back into new sources of production, according to Bloomberg.

From a climate perspective, President Biden’s threat to tax windfall profits if companies don’t use it for expanded oil production is problematic. Some critics pushed back on Biden’s use-it or lose-it framing. “President Biden is getting it wrong. America needs a windfall profits tax; we don’t need Big Oil to ramp up production,” Robert Weismann, president of Public Citizen, said in a statement. “Drilling more won’t lower prices for US consumers...And more investment in oil drilling will deepen our dependence on fossil fuels when the worsening climate catastrophe demands we speed the transition away from fossil fuels.”

It’s not clear that a tax on its own would do much to lower oil and gas prices. But returning proceeds to all Americans via some kind of rebate would defray energy bills. And the concept is popular. One poll pegs support at 80 percent, with only 20 percent opposed.

Representative Khanna emphasized that a windfall tax is already happening across the Atlantic, where it is widely accepted across the political spectrum.

“Look, Europe has already done this. I mean the Conservative government in England did it and they took that money and helped European ratepayers for their electricity bills,” Khanna said during the November 1 Twitter event. “And I don't understand if it's good enough for Europeans, why it wouldn't be good enough for Americans. We need people to have relief here.”

Britain’s Conservative government imposed a 25 percent tax on oil and gas producers — on top of existing tax rates — earlier this year and is now under growing pressure to hike that levy and extend it through the late 2020s.

In light of the political winds in the UK, Shell’s CEO Ben van Beurden said in late October that it was a “societal reality” that governments would be seeking to tax excess profits. “We should be prepared and accept that also our industry will be looked at for raising taxes in order to fund the transfers to those who need it most in these very difficult times,” he said. “We have to embrace it.”

In fact, a few weeks after Russia’s invasion of Ukraine, the European Union advised member states to impose windfall taxes on energy companies to fund compensation programs for ordinary people. Since then, an estimated 15 European countries have either proposed or implemented such a tax.

But the prospects of such fossil fuel taxes are remote here in the United States, where fossil fuel corporations wield greater political influence due to their lock on the Republican Party. Midterm elections are a few days away, and it’s possible that Democrats may lose one or both chambers of Congress. Even if they manage to hold on, their margins will remain razor thin. Whatever the merits of a windfall profits tax, passing one into law remains unlikely.

“Look, this president, temperamentally, is fair. He doesn't like gratuitously going after bad actors, and for him to come to this point shows that he's at his wits end,” Representative Khanna said. “I mean, he has met with them, he's reasoned with them, but they're still gouging Americans, and they're doing so at a time where people are patriotically standing up to Putin. Why should they be profiting off of this?” he said, referring to oil companies and their executives.

Khanna said the legislation could move forward soon. But, “it really depends on who controls Congress.”

The Magazine of The Sierra Club

The Magazine of The Sierra Club