Sunlight for Sale

Buying into America's fastest-growing energy source makes more sense than ever. And not just for wealthy enviros.

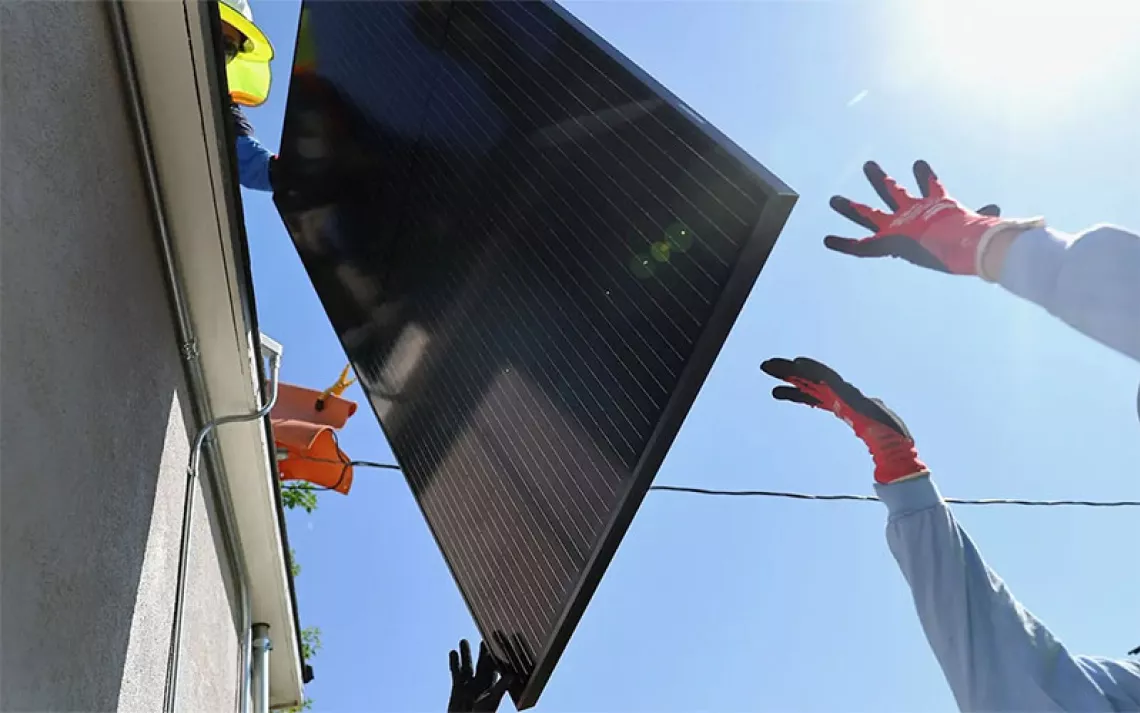

Motivated by tax breaks, solar's decreasing cost, and grid electricity's rising price, Americans like Tony and Arlene Silvia are turning to the sun to power their lives. | Photo by Josh Andrus

DURING THE FRIGID MASSACHUSETTS winter of 2013, Tony Silvia's checking account was hurting. He had paid several months' worth of sky-high electricity bills to run air conditioners the previous summer. Then the weather had flipped, and the monthly cost of energy for electric heaters in his 1,600-square-foot house was pushing $275.

"That's when I decided to see if I could do something about it," he says. Six months later, a crew from Solar City, the country's largest residential solar-power installer, arrived with 22 photovoltaic panels to stick on Silvia's roof.

On a household income of $85,000 a year—Tony is a retired firefighter; his wife, Arlene, is a retired school nurse—there was no chance that the Silvias could afford to buy a typical $15,000 solar system out of pocket. Instead, they signed on to a 20-year lease. Solar City owns the panels, and the Silvias pay the company $90 per month for the energy. In a typical month, they save up to $100 compared with what they paid before the panels went up. During productive summer periods, Silvia says, his panels produce surplus energy that he sells back to his power company, which gives him credit to buy electricity from the grid on cloudy days.

"I'm really glad I did it," he says. Plus, "I get to help the environment a little bit."

A lot of U.S. residents are having the same idea. A new home or business goes solar every 2.5 minutes. As of early 2014, the amount of carbon dioxide emissions prevented by solar panels in the United States was roughly equal to taking 3.5 million cars off the road.

Solar power has the stigma of being prohibitively expensive. Ever since residential rooftop solar started to gain popularity a decade ago, solar companies have catered primarily to affluent homeowners, mostly in California, who could plunk down tens of thousands of dollars for their panels. As of the first quarter of 2015, the average annual income for solar-equipped households was $117,000—in the top quintile of U.S. household incomes—according to a Bloomberg New Energy Finance survey. On the other end of the spectrum, households earning less than $40,000 a year account for only 5 percent of all solar installations, according to a recent George Washington University study. That's because low-income households are less likely to own their own roof (if they rent in an apartment building, for example) and because they tend to have lower credit scores, which restricts their financing options. Yet low-income households stand to gain the most by going solar. They receive comparable electricity bills to those of higher-income households, so energy spending consumes a portion of their budget up to three times higher than the national average. A recent survey funded by the Department of Energy found that for single-family homes, power from a solar system purchased with a full loan was cheaper than the grid in 42 of the country's 50 biggest cities as of January 2015.

Fortunately, as the rooftop solar market continues to grow, it's attracting more low-income households, drawn by plummeting prices of solar panels and a panoply of government incentives.

For starters, the per-watt cost of solar systems has been cut in half since 2008, meaning you no longer have to be rich to own one. Meanwhile, the price of grid electricity continues to rise.

Then there are the tax incentives. The federal Investment Tax Credit enables homeowners and businesses to write off 30 percent of their solar system cost. Many states have similar deals. In New York, for example, homeowners can deduct up to $5,000 of solar costs.

But because the sticker price may still be too steep, many of the larger companies that sell solar panels also offer loans or low-interest payment plans. Some solar-leasing companies offer financing options with no down payment, essentially replacing a homeowner's electricity bill with a lower-cost monthly fee for solar. Since 2012, a majority of residential solar systems—like the Silvias'—have been leased rather than purchased. And community-owned solar farms, which allow "subscribers" to purchase solar from an off-site array rather than having their own rooftop panels, are projected to grow by leaps and bounds in the next few years—a boon for renters who don't own their roof.

The push to make solar more accessible recently gained a powerful ally in President Barack Obama, who in August 2015 proclaimed to a clean energy conference in Las Vegas, "For decades, we've been told that it doesn't make economic sense to switch to renewable energy. Today, that's no longer true." The White House recently added $1 billion in federal loan guarantees for renewable energy projects, including rooftop solar, and tripled the target for solar installations on federally subsidized housing. It also opened the door to a new financing option, known as "property assessed clean energy" (PACE), which lets homeowners leverage the value of their house to get a solar loan. In this model, your municipal government pays a solar company to outfit your house, and then you pay it back over time through property taxes.

Of course, more solar means fewer customers for traditional electric utilities, igniting a nationwide war on solar by those companies and their allies in state legislatures (see "Throwing Shade"). A recent survey by the Energy and Policy Institute tallied ongoing campaigns to weaken renewable energy policies in 27 states.

In some cases, those campaigns have specifically targeted minority communities with the message that the solar boom will shut them out and raise their energy bills. The National Black Chamber of Commerce, for example, has opposed legislation in Florida that would make it easier for homeowners and businesses to sell off excess power they produce through solar. Its campaign was bankrolled with funds from a major coal-dependent power company and the Koch brothers. (The NAACP, meanwhile, has pushed back with a series of resolutions and reports on the economic windfall of solar for minority communities.)

In any case, it seems unlikely that the mud-slinging campaigns will succeed in pulling the plug on solar, which is the fastest-growing energy source in the country. As Silvia puts it, the deal is just too good: "I like the electric bill the way it is now."

Concerned Scientists

Jennifer and Joseph Jaskolka, Ravena, New York

Photo by Nathaniel Brooks

Provider: RGS Energy

Monthly payment: $75 toward loan, plus $17 to utility company

Monthly energy bill savings: $10

Annual household income: $120,000

Payment plan: 12-year loan

Going solar was at the top of Jennifer and Joseph Jaskolka's list, but the sticker shock held them back—until they found out about a tax incentive and a loan plan that adjusted their monthly payments to match what they had been paying for grid electricity.

"My husband and I are both middle school science teachers. We've always been interested in the environment and the plight of the world. We have a little son—he's two years old—and we decided we needed to do the right thing.

"We don't have the money to just buy [the panels] outright. We found a loan plan that spreads out the payments so they're the same as your average electricity bill cost, and after the payment period is over, we pay nothing. That was the big selling point for us. Tax incentives removed about 50 percent of the cost. A new car would cost way more than what we're paying for solar. If the system were the full price, without all the incentives, it probably wouldn't be realistic for us to do.

"Every day now, I look at the meter. It's kind of a fun obsession. I can see the numbers going backward. I would collect data, but I'm a little more grounded than that. We get a lot of sun. Every sunny day in January, we used to be like, 'Ah, if only we had panels!' Now every sunny day, I'm like, 'Oh, I'm so glad we have panels.'"

Capital Conscience

Genora Reed, Washington, D.C.

Photo by Benjamin C. Tankersley

Provider: GreenBrilliance

Monthly payment: $18 to utility company; paid $9,750 for panels via grant

Monthly energy bill savings: $50

Annual household income: $30,000 when she qualified for grant; higher now

Payment plan: Municipal grant

When Genora Reed first moved to the D.C. area, she noticed solar panels on a lot of her neighbors' homes. At the time, she was unemployed and her husband worked part-time. Solar was out of her reach, until she tracked down a grant from city hall.

"I'm originally from Tennessee, and I currently work for the federal government, for USAID. My husband and I have a beautiful four-year-old son. We bought a house in southeast D.C. in 2011. The Low Income Home Energy Assistance Program is widely used in my neighborhood, so the government pays many people's energy bills.

"I used to live in Takoma Park, near D.C., and a lot of the homes in that neighborhood had solar. One of the homeowners told me that she'd paid twenty grand for her panels. I was thinking, 'Wow, I don't see how I'm gonna get twenty grand just to buy some solar panels.'

"I started hanging out on the district's Department of Energy & Environment website, and I came upon this solar grant from the D.C. government. I wasn't working, and my husband was teaching part-time, so our joint incomes qualified for the program. I got $9,750 for solar panels and bought a smaller system for that price. It was connected this year [2015] at the end of spring.

"Now I'm just reaping the benefits. This is an opportunity for us to decrease our energy bill without using public assistance. It's an opportunity to decrease our carbon footprint and save money. And to do it without an out-of-pocket expense is awesome."

The Homesteader

Patti Cook, Maui, Hawaii

Photo by Aric Becker

Provider: Haleakala Solar

Monthly payment: $18 to utility company; paid $30,000 for panels

Monthly energy bill savings: $200

Annual household income: $50,000

Payment plan: Cash

Patti Cook worked as a city planner in Honolulu before deciding to take advantage of her Hawaiian heritage and buy "homestead" property reserved for island natives. It's in a beautiful spot, next to a golf course, but her electricity bills used to be crushing.

"Electricity is very expensive in Hawaii. The bill used to be up to $200 a month, if I had my grandchildren visiting or whatever. So on electricity, naturally, I constantly look for things that can help me. That was the motivation right there.

"I walked into Haleakala Solar's office, and this young man showed me what [the solar array] would look like. That was important to me, because I just hate mechanical things, and I didn't want it showing.

"He also told me about all the tax credits I'd get from the state and federal governments. That was instrumental. I chose to own the panels outright.

"At first I thought I'd have to deal with all these wires, and it never happened. It's like I never did anything. But I've been saving a lot of money on the bill. Now that the system's all connected, I don't pay much. It's like $18 a month. I had already placed 19 panels on my roof, and I just extended the house, so now I'm adding 5 more. It's a time-saver and a money-saver, and it's wonderful all around."

This article was funded by the Sierra Club's Beyond Coal campaign and appeared as "Sunlight for Sale" in the January/February 2016 print edition of Sierra.

The Magazine of The Sierra Club

The Magazine of The Sierra Club