At the end of July, the largest grid operator in the country — PJM Interconnection — announced eye-popping results in its capacity auction that threaten to send electricity rates soaring for people in the 13 states it serves and the District of Columbia. The overall cost of capacity — which PJM procures to ensure adequate resources to meet system needs — jumped from about $2 billion to nearly $15 billion. While PJM appears to believe that these extraordinarily high prices are fair, consumers, states, and the need for reform of the auction rules is urgent.

Representing Sierra Club, and in partnership with the Natural Resources Defense Council, Public Citizen, Sustainable FERC Project, and Union of Concerned Scientists, last week Earthjustice filed a complaint with the Federal Energy Regulatory Commission (FERC) to challenge rules in PJM’s capacity market that unnecessarily cost consumers billions of dollars — and that impose the greatest costs on disadvantaged communities that already bear some of the heaviest energy burdens in the nation. PJM’s capacity market exists to ensure that the region will always have enough power, even when electricity demand peaks or during emergencies such as winter storms when fossil fuel power plants may fail. However, when it runs capacity auctions, PJM does not account for certain types of power plants that consumers are already paying to continue operating under Reliability Must Run, (RMR), arrangements. PJM enters into RMR arrangements when a power plant’s retirement would threaten the grid, and the RMR arrangement stays in place until grid upgrades can be completed that let the plant retire safely. Consumers pay all the costs to keep the plant running — and RMR arrangements typically specify that PJM can call on them to generate electricity during emergencies, much like a power plant that sells capacity. PJM’s failure to account for RMRs means that when consumers buy capacity in PJM’s auctions, they pay twice for the same service — once to keep RMR units online, and again for promises from other power plants to provide the same capacity that the RMR units already provide.

Other regions protect consumers better. In New York and New England, grid operators have FERC-approved rules in place that require capacity markets to account for the fact that consumers are already paying RMR units to remain operational. In approving those rules in other regions, FERC repeatedly found that it is unreasonable to ignore power plants that consumers are already paying to stay online and consistently emphasized the need to avoid forcing consumers “to pay twice for the same capacity need.” Our complaint asks FERC to bring PJM’s rules in line with rules in other markets that it has already approved to protect consumers from unreasonable and excessive costs.

The impacts of PJM’s unreasonable policy on prices — and consumers — are extreme. Recent independent analysis from Monitoring Analytics, the Independent Market Monitor for PJM, shows that PJM’s failure to account for RMR units in its capacity market inflated the overall cost to consumers by $4.2 billion. Another independent analysis found the price impact was $5 billion.

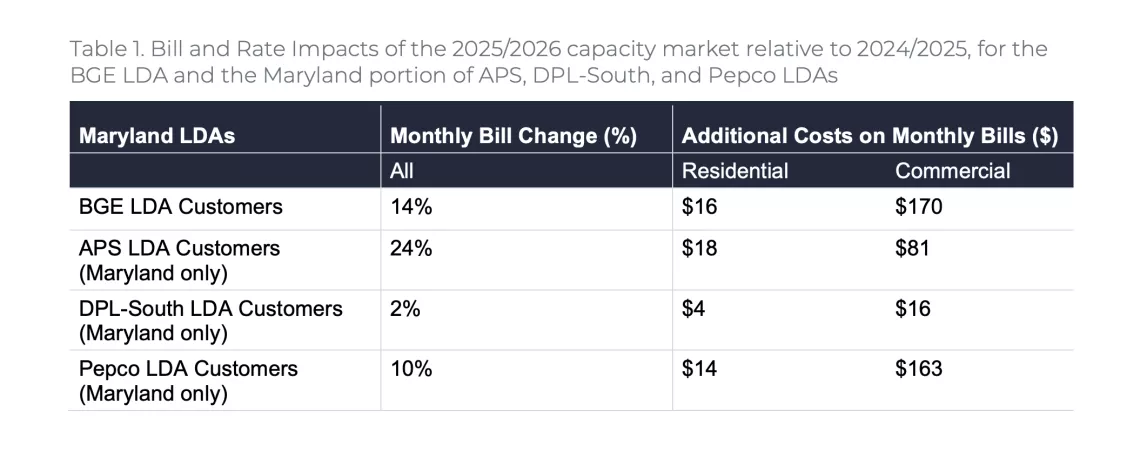

The most impacted consumers are people living in Baltimore and surrounding areas — what PJM refers to as the Baltimore Gas & Electric Locational Deliverability Area (“BGE LDA”). Two power plants operating under RMR arrangements are located in this area — and consumers there will pay these plants about $150 million annually to stay online until the grid can be upgraded. Because PJM’s capacity auction ignores that those power plants will provide capacity, the auction found that there is not enough capacity in the BGE LDA, meaning that the auction’s price surged to its highest possible level in that area. According to the Maryland Office of People’s Counsel’s independent assessment, the combined effect is that BGE consumers will likely see a 19% increase in their monthly electricity bills. Communities in the BGE LDA already face some of the nation’s highest energy burdens, ranking in the 98th and 99th percentiles. In other words, the biggest impacts from PJM’s unreasonable rules fall on ratepayers who can least afford them. PJM’s territory includes all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia.

Unless FERC requires PJM to change its rules, upcoming capacity auctions will likely further inflate prices for consumers. PJM currently has a rapid-fire schedule for capacity auctions, with auctions scheduled for December 2024, June 2025, and December 2025. While high capacity prices are supposed to send a signal for new generation to come online, the quick pace of PJM’s capacity auctions — especially combined with its slow, clogged interconnection process that has delayed clean energy projects from connecting to the grid — mean that new generation will likely be unable to come online fast enough to prevent price surges in upcoming auctions. PJM’s recent reforms to connect new energy generation remain insufficient, and PJM is opposing FERC’s speedier requirements in court despite having the largest number of active projects stuck in its queue (3,309 at the end of 2023). For years, PJM has failed to approve and connect new sources of clean energy to the grid and plan for necessary transmission.

Unfortunately, the use of costly RMR agreements may accelerate over the next decade, which would continue to drive up costs for consumers in future auctions. While many fossil fuel plants are shutting down because they are too expensive or too polluting, new resources may be slow to come online because PJM has repeatedly failed to reform its interconnection process. Combined with the fact that PJM does a poor job of upfront planning for transmission upgrades that would allow power plants to retire promptly, PJM may use RMR arrangements more frequently.

It is critical that FERC put a stop to PJM’s current practice of requiring consumers to pay hundreds of millions of dollars for RMR arrangements and also pay exorbitant capacity prices that ignores the existence of those RMRs.

The reforms we’re seeking at FERC would also ensure that the capacity market sends accurate signals to power plant owners about whether new investment is needed. PJM consumers don’t expect reliability for free — where demand is growing, prices may need to rise for a time. But FERC must not countenance exaggerated price spikes that reflect a false picture of supply and demand in the region. Better accounting for RMR units in the capacity market would reduce prices, but would not hamper the capacity market’s ability to send valid signals for the development of new generation that reflect real-world needs. If FERC acts quickly, it can protect consumers, including those who already suffer the highest energy burdens, from extreme electricity price spikes.

It is critical that FERC put a stop to PJM’s current practice of requiring consumers to pay hundreds of millions of dollars for RMR arrangements and also pay exorbitant capacity prices that ignores the existence of those RMRs.

Sierra Club's Casey Roberts and Earthjustice's Nick Lawton