By Matt Johnson

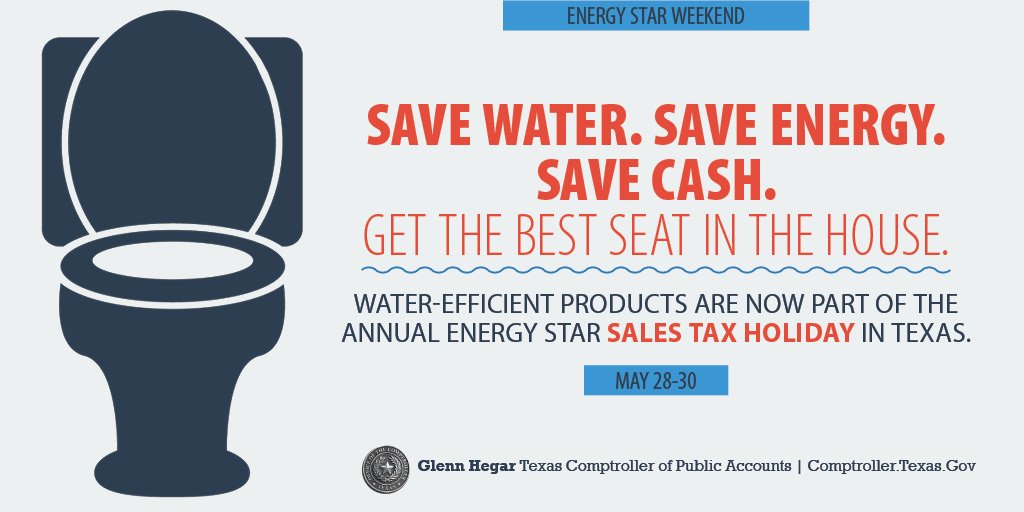

There are many great things about Memorial Day weekend. One of them happens to be a sales tax holiday on energy and water-saving appliances. That’s right. This weekend, all across Texas, you won’t have to pay state or local sales tax on a variety of Energy Star appliances and WaterSense products, which will also save you money on your electric and water bills. But you should be aware of a change this year.

Back up, what’s this about a sales tax holiday?

If you’ve been holding off replacing old appliances or improving your garden or landscape, the sales tax holiday weekend is a great opportunity to check them off your to-do list. The Texas Comptroller of Public Accounts website lays out what is eligible.

For energy-saving products, the Comptroller says: “During Memorial Day weekend, Texas shoppers get a break from state and local sales and use taxes on purchases of certain energy efficient products. The 2016 ENERGY STAR sales tax holiday begins at 12:01 a.m. (after midnight) on Saturday, May 28, and ends at 11:59 p.m. on Monday, May 30 (Memorial Day). The products qualifying for the exemption are:

- Air conditioners priced at $6,000 or less

- Refrigerators priced at $2,000 or less

- Ceiling fans

- Incandescent and fluorescent light bulbs

- Clothes washers

- Dishwashers

- Dehumidifiers

- Programmable thermostats"

It’s worth checking out the FAQs on the website before you buy. You don’t want to get to the cash register only to find out the item you want to buy doesn’t qualify. Eligible items are limited to those items specifically listed in Tax Code Section 151.333.

And it goes for water-saving products too!

In addition to energy-saving products, the Texas Legislature added water-saving products, including showerheads, toilets, etc., as well as outdoor items. But what qualifies as a water-saving product? Click here to get the full list. Here are a few new items:

- a soaker or drip-irrigation hose

- a moisture control for a sprinkler or irrigation system

- mulch (yay, mulch is in statute!)

- a rain barrel or an alternative rain and moisture collection system

- a permeable ground cover surface that allows water to reach underground basins, aquifers, or water collection points

Sounds good, right? Well, most of it.

As a result of the language in SB 1356 - language that came from some lobbyists and trade groups - and the interpretation of that language by the Comptroller's Office, there is an overly broad inclusion of products that qualify for this short-term sales tax exemption.

The sales tax exemption is going to apply to "plants, trees and grasses" - as in all plants, trees and grasses, including water intensive St. Augustine turf, and other vegetation that requires a heck of a lot of water. Fortunately, in this case, the exemption is only for a residential property owner, not a developer, so there is some limitation there.

If you are planning to buy water-saving products this weekend, make sure they stay true to the intention of the Sales Tax Holiday and help Texas conserve our most precious resource: water. Rain barrels, drip-irrigation hoses, and even mulch (which helps retain moisture around shrubs), are great ways to help do your part to conserve water.

Photos: Texas Comptroller of Public Accounts, North Country Community Theatre