Is Your Bank Financing Climate Catastrophe?

Spoiler: Probably yes. If it's JPMorgan Chase, most definitely.

Illustration by Pineapple Studio/iStock

A bank robbery is taking place. Major banks—maybe yours—are robbing you of a chance to live and thrive in a stable climate, according to the 10th edition of "Banking on Climate Change," a report released in March 2019 by BankTrack, Honor the Earth, Indigenous Environmental Network, Oil Change International, Rainforest Action Network, and the Sierra Club.

The report grades 33 global, private banks on their financing of and policies toward the fossil fuel sector. Grant Marr, a research associate at the Rainforest Action Network and coauthor of the report, calls it “the fullest accounting so far of these banks’ contribution to climate change.” Here are some key takeaways.

Between 2016 and 2018, 33 global banks have financed fossil fuels with $1.9 trillion.

To put that in perspective, that’s comparable to the United States’ entire military budgets for those years. And this fossil fuel financing is on the rise since the Paris Agreement was adopted.

The Paris Agreement said that we should be “making finance flows consistent with a pathway towards low greenhouse gas emissions and climate resilient development.” The goal set by the Intergovernmental Panel on Climate Change (IPCC) in October 2018 was for global emissions to become net zero by midcentury to limit warming to 1.5°C.

“Bank fossil fuel financing needs to match that [Paris Agreement and IPCC] trajectory,” Marr says, “but it keeps going up. That's not in line with what we need; it’s not even the right direction.”

Image courtesy "Banking on Climate Change"

While the overall picture is dire, the report does note that 21 of these 33 have restricted some coal financing; 10 (all European) have some restrictions on tar sands oil financing; and just one has some restrictions on fracking and LNG financing—BNP Paribas.

Marr says that Bank of the West, owned by BNP Paribas, might be a good choice for Americans: “BNP Paribas still has a long way to go, but has mades some really impressive moves toward a stable climate.”

$600 billion of this financing supported fossil fuel expansion.

Our carbon budget—the estimated amount of CO2 we can emit while limiting global temperature rise—has no space for new fossil fuel projects. Without radically altering how we produce and consume energy, the world will exhaust its carbon budget to keep global temperature increase below 1.5°C by 2030. And yet banks supported fossil fuel expansion companies with $600 billion in the last three years.

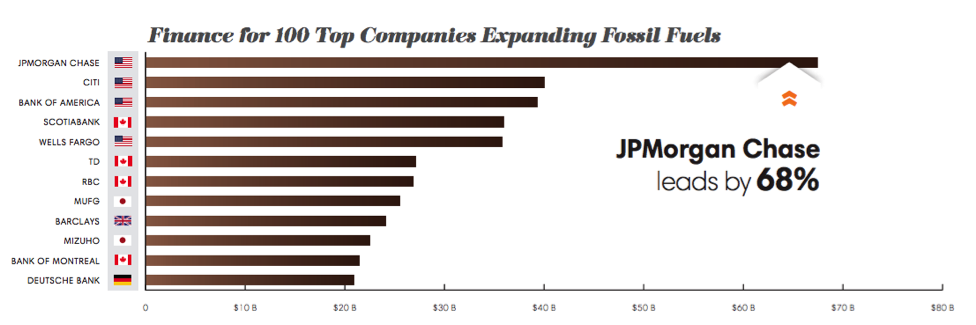

For the first time this year, "Banking on Climate Change" analyzed bank financing for top expanders of the fossil fuel industry. These include the biggest 100 companies that are planning new fossil fuel projects like pipelines, coal mines, coal plants, and tapping new reserves. JPMorgan Chase was the worst of the lot by a wide margin, but it’s joined by some of the largest North American banks as the biggest bankers of expansion.

Image courtesy "Banking on Climate Change"

“The global climate cannot even handle existing projects, let alone any expansion,” says Marr. “All of this financing to companies that are expanding fossil fuels is just totally incompatible with a stable climate.”

The report recommends that banks stop financing expansion of fossil fuel extraction or infrastructure “via project finance (direct financing for a fossil fuel asset) or general corporate support (financing provided to a company overall).”

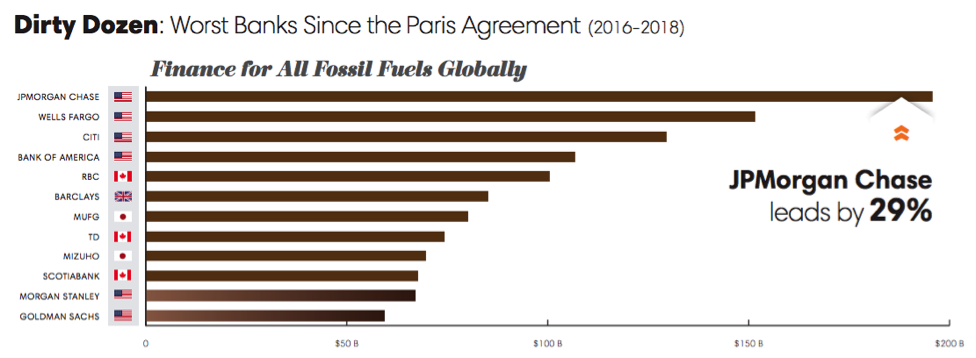

JPMorgan Chase is the worst.

This is not the kind of list you want to be part of, and most certainly not lead. According to the report, JPMorgan Chase is “a bank that is financing climate change more than any other in the world, and which has shown no indications of having any plans to change course.”

JPMorgan Chase has no policies restricting finance to Arctic oil and gas, ultra-deepwater oil and gas, liquefied natural gas, tar sands oil extraction, and fracking. It leads financing for all four key tar sands expansion companies. In the past three years, it has funded fossil fuels with $196 billion.

But most US banking giants are pretty terrible too.

JPMorgan Chase, Wells Fargo, Citi, Bank of America, Morgan Stanley, and Goldman Sachs are all in the top dozen "dirty" banks for fueling climate change.

Image courtesy "Banking on Climate Change"

"Already, more than 25,000 people have sent messages to the largest US banks' CEOs urging them to do better,” says Ben Cushing, a representative of the Beyond Dirty Fuels campaign at the Sierra Club. “We plan to keep the pressure up online, at their branches, and at their shareholder meetings until they get the message that they need to stop funding climate destruction."

Finance for fracking is on the rise.

The report looked at bank support for the top fracked oil and gas producers and transporters, and it’s on the rise. Wells Fargo and JPMorgan Chase are the biggest bankers of fracking. They support companies active in the Permian Basin, Texas, which remains at the center of a global surge in oil and gas production.

“If we want a stable climate, these reserves need to be kept in the ground, they just cannot be extracted,” Marr says.

Nothing is safe, not even the Arctic.

US banks, unfortunately, lag here too, even though the Trump administration's proposed opening of the Arctic National Wildlife Refuge to oil drilling poses a threat not only to the climate but to the way of life of the Gwich’in people.

Recognizing this, some European banks have ruled out project or corporate-level financing for drilling or exploration in the Arctic, and a few others have made commitments to restrict financing for oil and gas production in this region. But no US bank has committed to not financing drilling and exploration in the region.

The Magazine of The Sierra Club

The Magazine of The Sierra Club